These Related Stories

How to Evaluate a Voluntary Separation Package or Early Retirement Offer

Share this

.png?width=554&name=BLOG%20IMAGES%20TEMPLATE%20(3).png)

6.0 MIN READ

You have spent decades planning for retirement. Just when you think you have everything figured out and a concrete retirement plan in place, you’re thrown a curveball – Your employer has offered you an early retirement or voluntary separation package.

You were planning on retiring in a few years. Now what?

Sure, the offer comes with some extra pay. But what else should you consider? How do you begin to evaluate a voluntary severance offer?

Whether your employer calls it a voluntary severance or separation package, a retirement buyout, or an early retirement offer, your options are the same. You can accept the offer and retire soon with some added benefits, or reject the offer and continue working.

We’ve summarized a few of the most important factors to consider when weighing a voluntary severance package below.

We’ve helped clients who were employed by Collins Aerospace, John Deere, P&G, and other Iowa corridor companies evaluate their severance packages.

Learn more: Watch our webinar replay below about evaluating voluntary separation packages. Simply click play on the video below and enter your email when prompted:

Benefits and Drawbacks of Accepting a Voluntary Separation Package

The early retirement incentives provided by the voluntary separation package may include extended health benefits, a lump sum bonus, future annual payments, added years of service for pension benefits, and more. For someone close to their planned retirement date and in a good position to retire today, an early retirement offer can put them in better financial shape than they would have been otherwise.

However, accepting the retirement offer can also mean lower Social Security benefits, lower pension benefits, increased 401(k) or IRA withdrawals early in retirement, increased health care expenses, and many more complications. Therefore, accepting an offer before you are financially ready to retire can have severe consequences.

The Most Important Factors To Weigh in Your Decision to Accept a Voluntary Separation Offer

When weighing an early retirement offer, the most important considerations are your:

- Retirement assets

- Age

- Health care options

Let’s drill down into some of the most significant aspects of these factors.

Managing Your 401(k), IRA, and Other Retirement Accounts with an Early Retirement Package

Accepting an early retirement offer or voluntary severance package may require you to begin withdrawals from your 401(k), IRA, or other retirement accounts sooner than you originally expected.

Although you do not face any 10% early withdrawal penalties if you are age 55 or older and become separated from employment (this is commonly known as the “Age of 55 Rule”), withdrawing from your retirement accounts early could have a material impact on your long-term net worth.

Extra years of retirement can take a toll on your retirement nest egg. In fact, retiring earlier than planned can result in hundreds of thousands of dollars in extra expenses that your retirement portfolio must now support. It may also limit the growth of your assets already invested since you have to spend instead of save.

Can your retirement portfolio withstand fewer years of contributions and more years of withdrawals? This is the first question you need to answer when making your decision.

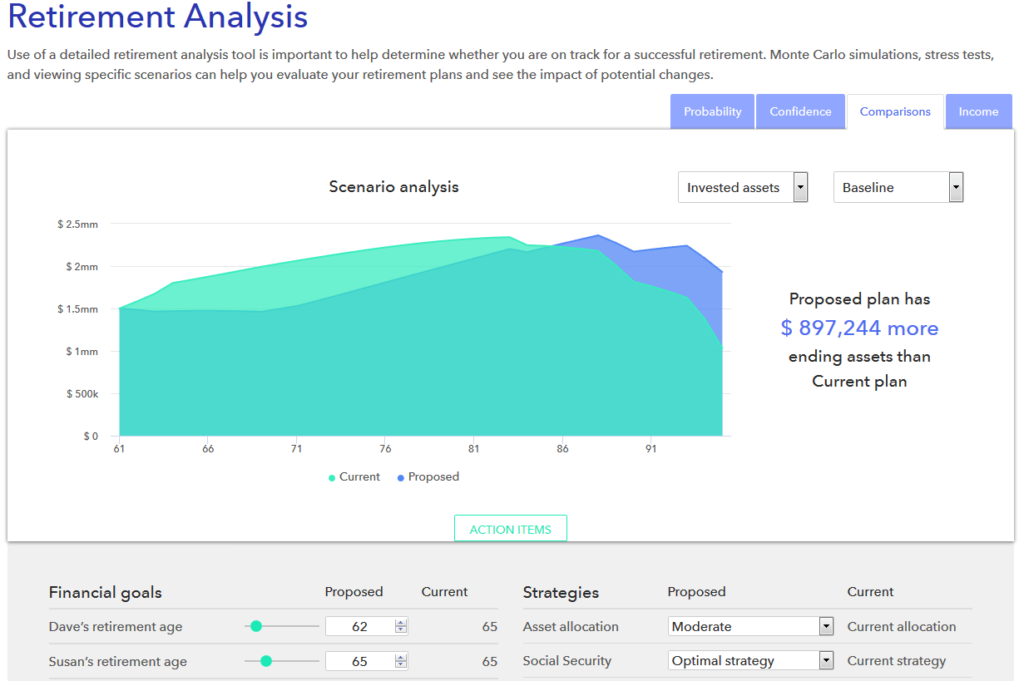

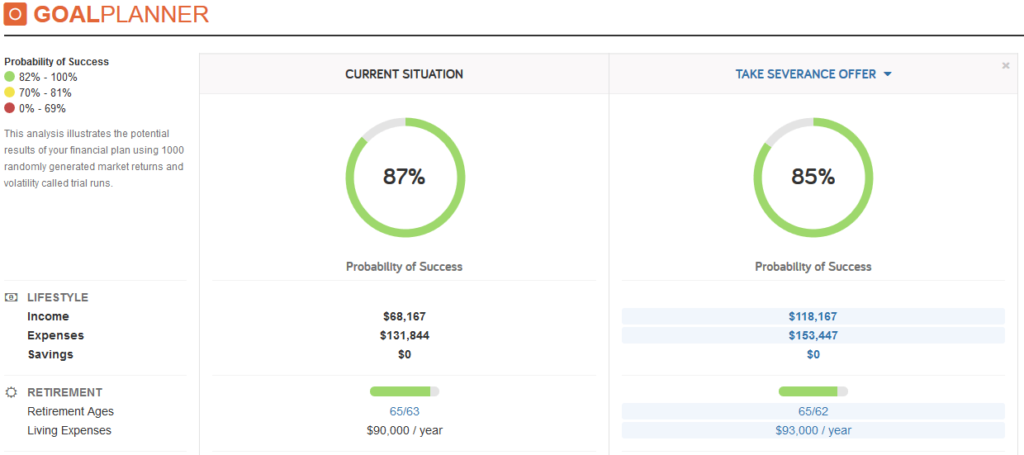

When we help clients answer this question, we commonly use monte carlo analysis. This allows us to simulate different scenarios side-by-side, and quickly see the impact accepting – or declining – an early severance offer will have on your financial plan.

Remember the Rising Costs of Health Care When Accepting a Severance Package

Health care has become one of the largest expenses for a retiree, even with good insurance. For many, a company’s contribution to your family’s health insurance premium is critical to keeping medical insurance and care, affordable.

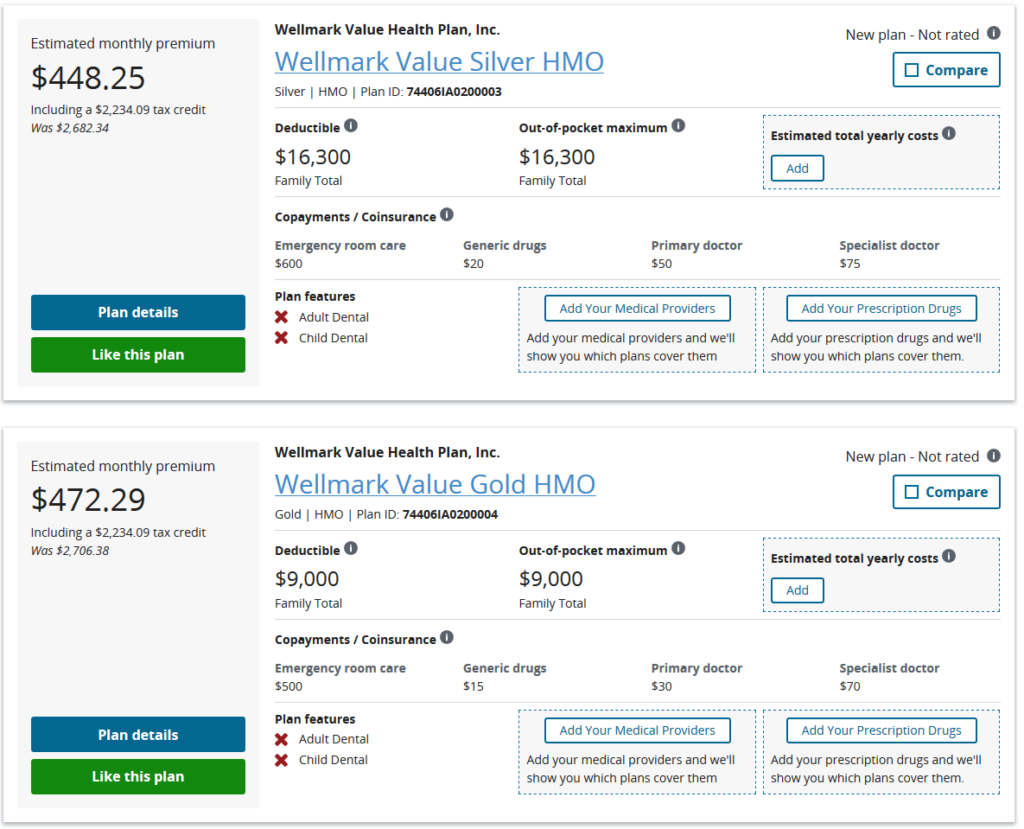

If you are lucky, your voluntary severance package will extend your health benefits. Health insurance will be needed until you are age 65 and become eligible for Medicare. However, not all those offered an early retirement package are so lucky.

If you will be on your own paying for health insurance after accepting an early retirement offer, COBRA insurance is always available. COBRA may extend your family’s coverage for up to 18 months. But, this coverage is expensive.

You also have the option of entering the open market for an insurance policy. You may want to consider this option if your separation package does not include health care, or only a small additional benefit to pay for health care. However, you may be faced with expensive premiums or high deductibles.

Before making a decision about an early retirement offer, determine if your severance package includes any health care benefits. If not, price out other health care options, such as those available on Heathcare.gov. Can the added expenses be supported with your retirement savings?

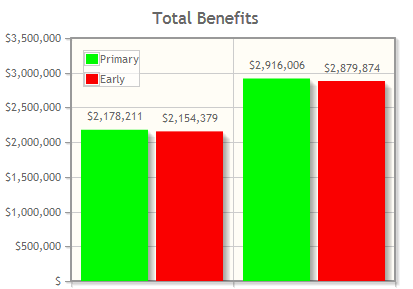

Your Social Security and Pension Benefits May Be Impacted by an Early Retirement

One potential consequence of accepting an early retirement offer is a reduction in Social Security benefits. Your future pension payments may also be reduced, depending on the language in your separation package.

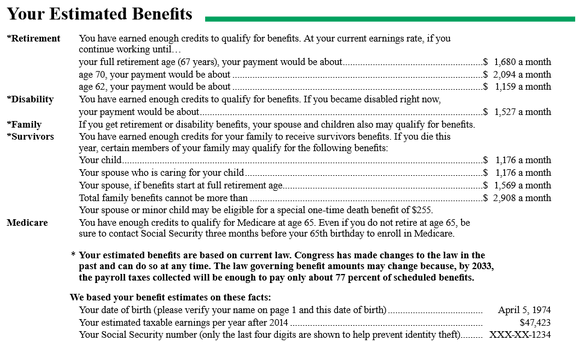

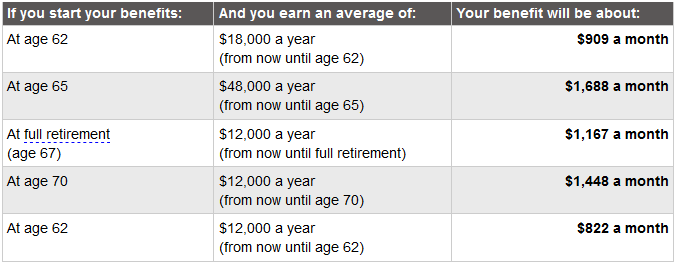

You have probably received your estimated Social Security retirement benefits from a statement that looks like this:

But, if you accept an early retirement package, the benefits listed on your statement is not what you will receive.

These estimated Social Security benefits assume that you continue to work and make your current salary. As a retiree who accepts an early voluntary severance package, your future income will likely be reduced. This means potentially lower future Social Security payments.

Likewise, your pension statement likely makes assumptions on years of service. If you accept an early retirement offer, your years of service may be less than what your pension statement assumes.

So, the first step is to determine what your Social Security or pension benefits will be if you accept the early retirement package.

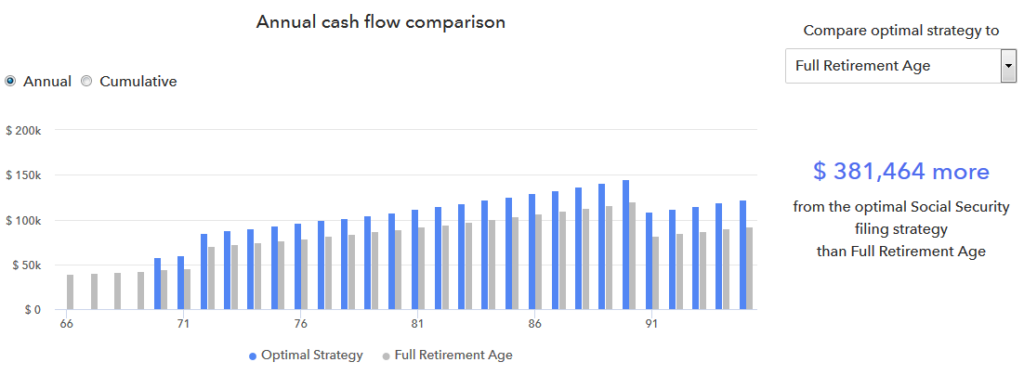

At Arnold & Mote Wealth Management, we use several different methods to determine your future pension benefits and your optimal Social Security selection.

Calculating your optimal Social Security and pension depends on the options you have available, your savings, and your spending needs.

Pensions, and particularly pension benefits for those who retire early, often have options for increased payments until the retiree eaches Social Security age. This is usually referred to as a ‘Social Security Offset’ option. This option adds more to your early benefits, but your lifetime benefits may be reduced.

You also will have to consider what portion of your pension would be left to your spouse if you were to pass away in retirement. For most, the peace of mind by ensuring their spouse will receive a sizeable pension, is best. However, this will leave you with lower monthly benefits.

You may know that your monthly Social Security benefit is increased the longer you delay beginning your benefit. But, that requires you to very likely draw down on your retirement savings more early on in retirement.

So, not only is it important to known which Social Security strategy gets you the most money in total, but also which options fits best with your retirement plan.

If you are evaluating the early retirement offer on your own, you can start by using the Social Security Administration’s Benefits Estimator.

From there, you can enter estimated future income to arrive at an estimated correct Social Security benefit.

Once you have this updated, compare your new estimate to your monthly expenses. What impact will this reduced benefit reduction will have on your retirement plan and anticipated retirement account withdrawals?

Accepting an early retirement offer may force you to tap into your retirement savings, such as your 401(k) or IRA earlier, or it may mean changing when you will need to begin Social Security.

Learn more: Watch our webinar about evaluating voluntary separation packages, and read this Wall Street Journal article, Should You Consider Early Retirement in a Recession?

If You Accept a Voluntary Separation Package – Consider Roth Conversions

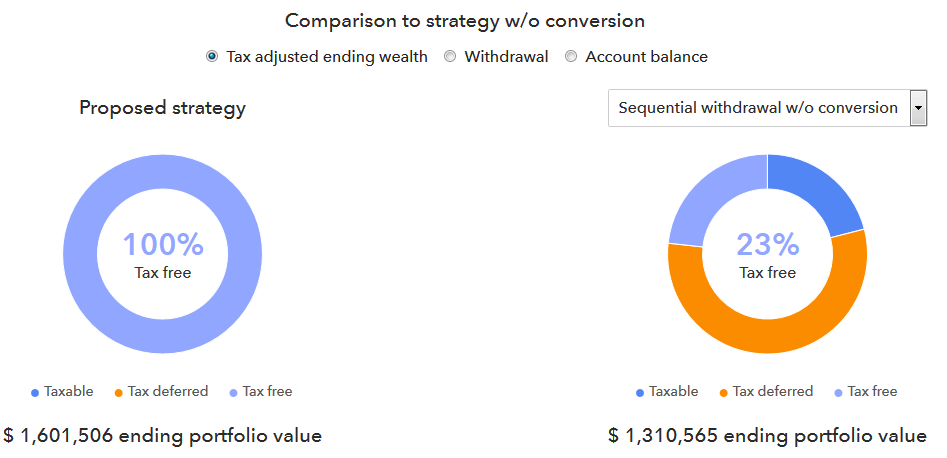

For those with retirement account assets in tax deferred retirement savings accounts (like 401(k)s and IRAs), an early retirement offer opens up the potential to save significantly on future taxes.

Those who accept an early retirement buyout offer from their company will likely be facing a year or two of reduced income before Social Security benefits kick in. These years of reduced income can be the perfect time to convert some assets within your 401(k) or traditional IRA into a Roth IRA.

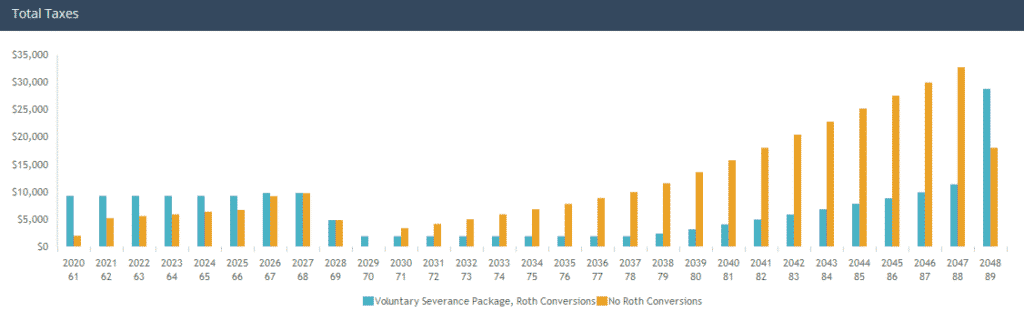

Roth conversions can be an incredibly valuable tool for those who accept an early retirement offer. They can increase asset longevity and reduce total taxes paid during their retirement.

Below is a screenshot from our tax planning software we use to help retirees understand and reduce their future tax liability in retirement. Many times we find those who retire early with a voluntary severance package have significant opportunities to take advantage of a extra low-earning years to perform Roth conversions and save on taxes.

Rejecting an Early Severance Offer

Of course, you have the option to say no to any voluntary severance package.

If you want to continue working, or are unable to retire early, this may be your best option. Working additional years can lead to pay raises, promotions, increased Social Security and pension payments, and increased financial stability.

However, rejecting an early retirement offer has potential drawbacks too.

First, there is no guarantee that the company will repeat the early retirement offer in the future. Assuming that another offer will come later is not always a wise move.

Second, and more importantly, realize that a company offering an early severance package to its employees is doing so to cut costs. If the company’s finances do not improve, there may be much worse outcomes in the future. The company may make layoffs, reduce employee pay, or eliminate other benefits.

About the Author

About the Author

Arnold & Mote Wealth Management was founded to help families and professionals from all walks of life make better decisions about how to use their money. Our clients are busy, with challenging careers and hectic family lives, and don’t always know where to turn for unbiased, quality guidance. Whether planning for their imminent retirement, struggling with setting aside money for their kids’ college years, or dreaming about a later-in-life career change, our clients want an independent voice to help them make and execute a plan.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Quinn's Find an Advisor profile.

Share this

- Good Financial Reads (924)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

Health Insurance Options for Early Retirement

![Retirement Saving Strategies for High Income Earners [Video + Free PDF]](https://advice.xyplanningnetwork.com/hubfs/Blog%20Images/Consumer%20Blog%20Images/Retirement%20Saving%20Strategies%20for%20High%20Income%20Earners%20%5BVideo%20+%20Free%20PDF%5D.png)

Retirement Saving Strategies for High Income Earners [Video + Free PDF]