These Related Stories

Health Insurance Options for Early Retirement

Share this

The number of workers opting for early retirement before Age 65 has been on an upward trend in recent years. Higher stock market valuations and worker burn-out are some contributors of this trend. While the idea of early retirement appeals to many, it can be costlier than you think. Not only do you need money set aside to cover daily expenses, but a critical cost that people forget about is for health insurance and healthcare. What are your health insurance options in early retirement, and how much might it cost you?

Why You Need to Plan for Early Retirement Years in Advance

Early retirement is an exciting prospect to look forward to, but needs to be planned for years before when you might want to retire early. Most of our monthly spending beyond housing, food and transportation is discretionary. Meaning, we can spend more or spend less and still get by. Here are the typical expenses you’d have to have savings set aside for in early retirement:

- Mortgage or rental costs

- Food at home and dining out

- Transportation and clothing

- Communication services, including mobile phones and home internet

- Conveniences, like streaming services and club memberships

- Higher travel budget while retired

- Healthcare expenses and insurance premiums

These expenses add up. The challenge is having funds set aside that you can draw from as you need to. Remember, you can’t start pulling money out of your IRAs and 401(k)s until you’re at least Age 59-½. So someone retiring in their early to mid-50s faces the challenge of covering living expenses from savings or an investment brokerage account.

Therefore, understanding the cost of health insurance is very important. It’s likely to be one of your biggest expenses in early retirement, something you’re not paying for while you’re working and covered by an employer insurance plan.

High Cost of Health Insurance in Early Retirement

Most early retirees are fully responsible for the cost of their healthcare expenses and insurance. Understanding how much this cost is critical to any early retirement plan.

The best and easiest way to gain a fast understanding of the potential cost of healthcare in early retirement is to look at government marketplace plans, also known as Obamacare. These are readily available and the most logical option for many.

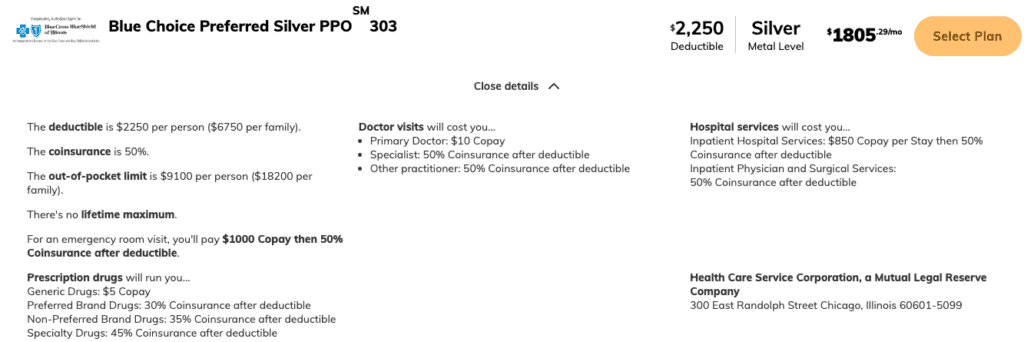

For the sake of this exercise, we’ll look at the total cost of an average healthcare plan using these assumptions:

- State of Illinois

- Married couple in mid-50s

- Preferred Provider Organization (PPO)

- Cheapest Silver Plan on Government Marketplace

- Assume no Premium Tax Credits that lower the monthly cost

Let’s add up all the direct costs and potential costs to getting healthcare coverage on this plan.

First, you have the monthly premiums. For this plan, you’d have to pay $1,805/month for an annual total of $21,660. That cost right there will immediately be one of your largest monthly expenses, behind your mortgage payment or rent. Most people that have health insurance through an employer don’t understand the full cost of that coverage; it’s not cheap!

Second, there are insurance deductibles. This plan has a $2,500 deductible per person, for a total of $5,000. That means that most of the first healthcare expenses you incur each year are your responsibility to pay, before insurance really kicks in.

Third, every plan has an out-of-pocket maximum that you’re responsible for. They sell this to people as a “good thing” in that there’s a cap on how much you have to pay for healthcare each year. But these out-of-pocket maximums can be large, as in the case here where it’s $9,100 per person, or $18,200 for the couple.

The worst-case, all-in cost of healthcare for a couple that fully uses coverage under this plan is enormous.

Compound this cost for each year in early retirement until you’re eligible for Medicare and it’s a big issue to consider before you retire!

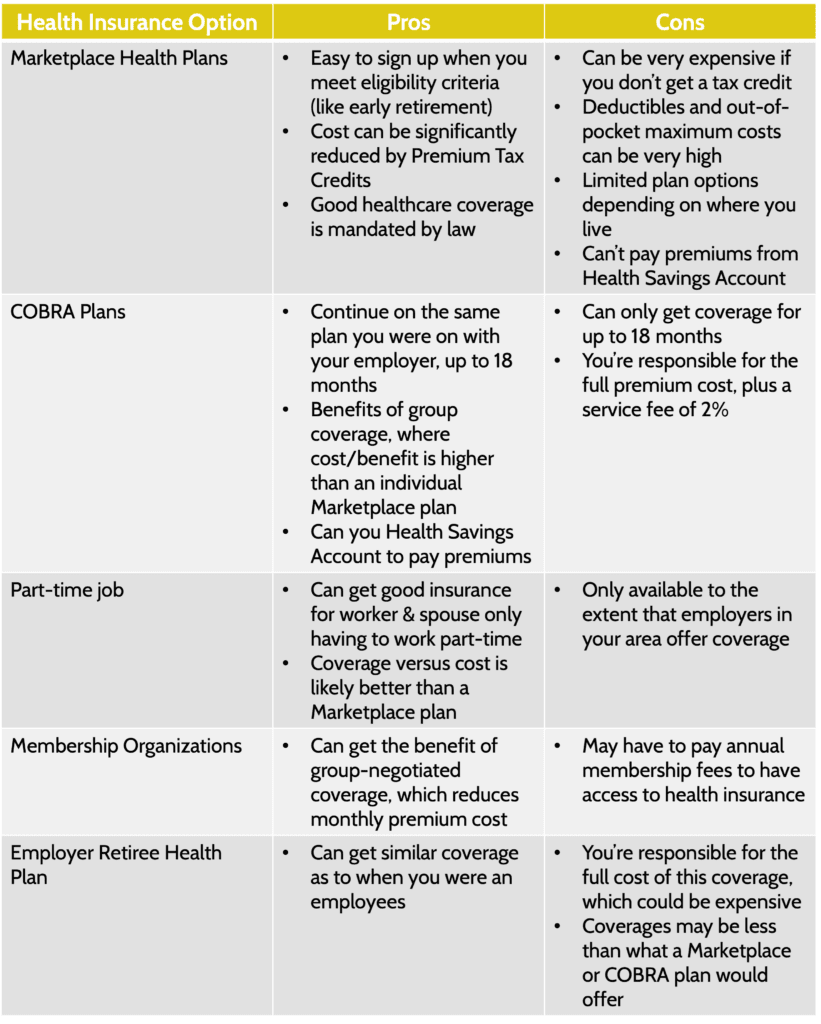

Option #1: Marketplace Health Insurance Plan

We’ve just seen how expensive these plans can be. But they are the easiest and most likely way early retirees can gain health insurance coverage.

However, there is a way to significantly reduce the cost of these plans: the Premium Tax Credit. This tax credit is a subsidy the government will provide to you to cover the cost of insurance premiums. The size of the subsidy is based on your annual income, which for an early retiree, may be quite low.

For example, a couple making $50,000 per year would get a Premium Tax Credit of $1,300/month, bringing the total monthly cost from $1,800/month to “just” $500/month. That adds up to $15,600 per year of health insurance premium savings.

The problem with counting on Premium Tax Credits to reduce health insurance premiums is that the credit goes down as your income goes up. One of the more powerful financial planning strategies for early retirees is taking advantage of Roth Conversions during these low income years. The potential tax savings from this strategy can be enormous.

However, if you’re doing a Roth Conversion strategy, you create income as you convert Traditional IRA money to a Roth. Remember, the higher your income, the lower Premium Tax Credit you get.

Marketplace plans, while one of the most logical options, need to be selected and planned for with other aspects of your retirement plan.

Option #2: COBRA Plans

Companies with over 20 employees are required by Federal law to offer continuing healthcare coverage for 18 months after a worker quits or retires. This law is called COBRA.

When most workers hear of COBRA coverage, they automatically assume it’s expensive. It usually is. You’d have to cover the full, monthly, cost of the insurance your company provides. This could easily top $2,000/month.

However, because your company is on a group insurance plan, they’re usually able to negotiate much better plans for the price paid. Deductibles and out-of-pocket maximums are also usually lower.

There is one HUGE benefit to choosing a COBRA plan if you’ve been saving into a Health Savings Account (“HSA”). You’re able to pay COBRA insurance premiums from your HSA. The option to pay health insurance premiums from your HSA is NOT available for Marketplace plans. So if you’re planning for early retirement, stashing some money into an HSA can be a great way to pay COBRA premiums.

Option #3: Getting a Part-time Job That Provides Health Insurance

It may seem odd to say “get a part-time job” when the goal of early retirement is to stop working! But time and time again, we see clients who early retire from a high-stress job but aren’t ready to lie around on the beach yet. They still want to be active and keep their mind sharp.

Because of the labor shortages we have in the United States, more big companies are offering higher pay and benefits to part-time workers. For example, you can get a job at Costco working just 24 hours a week and get excellent healthcare coverage for yourself and your family.

Getting a low-stress, part-time job can have many benefits:

- You can have one of your largest early retirement expenses (healthcare) covered by employer insurance.

- Earned income, even modest levels, reduces the need for you to pull money out of savings to cover living expenses.

- Some people just enjoy working so they feel productive.

The key here is doing the research on which companies offer benefits to part-time workers. And this might depend on which companies are around the town you live in.

Option #4: Group Health Through Membership Organizations

If you’re a licensed professional in your line of work, make sure you check out health insurance options these professional organizations might offer. Because these organizations can get group coverage, the insurance can be cheaper and cover more than a typical Marketplace plan.

Option #5: Employer Retiree Health Plans

Some employers will offer the option for a retiring employee to continue coverage under a Retiree Health Plan. The most common is retiree health plans that were negotiated as part of a union contract. Teachers and other government workers would likely have this option available to them.

The issue with retiree health plans is that they are sometimes scaled-down versions of the health insurance offered to full-time employees. In the cases we’ve seen at FDS, it wasn’t a viable option for early retirees. But these plans are out there and might be an option.

Summarizing Your Health Insurance Options for Early Retirement

Powerful Early Retirement Savings Plan: Health Savings Accounts

If you’re thinking of early retirement, make sure you check out Health Savings Accounts (“HSAs”) while you’re still working. Many people that have HSAs contribute money to them each year, but then use those same funds to pay current medical expenses.

HSA can be a powerful savings tool, both for retirement and early retirement. You can invest money that is contributed to an HSA for the future, much like your 401(k) or IRA. Then, when you have qualifying medical expenses, you can pull money out of your HSA tax-free to cover those costs. Effectively, HSAs are a pool of money that you put aside to deal solely with healthcare costs.

How does having an HSA help in early retirement?

First, you can pay premiums for COBRA coverage from your HSA. This is a unique benefit that only applies to COBRA; you cannot use HSA savings to pay Marketplace or other health insurance premiums. Despite the (likely) high cost of COBRA coverage, if you’ve done your work to save money for that into an HSA, you’ve got that cost covered.

Second, you can pay for qualifying medical expenses out of your HSA, tax-free. Doctor visits and copays, along with many other normal expenses qualify. An HSA account becomes a substantial source to cover these out-of-pocket expenses that would be paid under a Marketplace plan, for example. Given the high deductibles and out-of-pocket maximums for many Marketplace plans, having a fully stocked HSA can limit the amount you have to take out of day-to-day savings to cover these costs.

HSAs provide you a lot of tax benefits and flexibility to cover medical costs in early retirement.

Next Steps for Planning an Early Retirement

When we have clients express an interest in retiring early, we do a lot of work to make sure they’re prepared for it. The last thing someone wants to do is retire from the rat race, only to have to get a job again because the cost of early retirement was higher than they expected.

We model a wide range of healthcare scenarios for our clients, assessing the tradeoff between doing Roth Conversions and getting a Premium Tax Credit on a Marketplace plan, for example. And if the client is several years away from retiring, we look at available HSA options at their employer to help build a “warchest” of dedicated healthcare funds for early retirement.

Health insurance is just one important consideration for early retirement.

.png?width=324&height=324&name=Blog%20Contributor%20Headshot%20Style%20(400%20%C3%97%20400%20px).png)

About the Author

Rob has over 20 years experience in the financial services industry. Prior to joining Financial Design Studio, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm which was eventually merged into FDS.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! Find an Advisor.

Share this

- Good Financial Reads (924)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

What You Need to Know to Retire Early at 55

Good Financial Reads: Retirement Topics Made Easy: What Is Early Retirement, Self-Directed, and Consolidation?

![Retirement Saving Strategies for High Income Earners [Video + Free PDF]](https://advice.xyplanningnetwork.com/hubfs/Blog%20Images/Consumer%20Blog%20Images/Retirement%20Saving%20Strategies%20for%20High%20Income%20Earners%20%5BVideo%20+%20Free%20PDF%5D.png)