These Related Stories

How to Choose Beneficiaries with Taxes in Mind

Share this

15.0 MIN READ

Unlike most experiences in life that you can do more than once, you get one opportunity to choose your beneficiaries wisely. Once you die, it’s nearly impossible for your heirs to undo your beneficiary mistakes.

Before reading this article, I recommend reading my article about costly beneficiary mistakes to avoid. It will help make sense of beneficiary terminology, general rules of thumb, and how to identify costly beneficiary mistakes.

This is a deeper, more technical dive into how to choose beneficiaries tax-efficiently.

There are many mistakes I’ve seen over the years where people split accounts evenly, which ends up with more money going to the government in the form of taxes than they otherwise needed. This meant the beneficiary received less money than they could have.

If you want to try to optimize the amount your heirs receive, this article is for you.

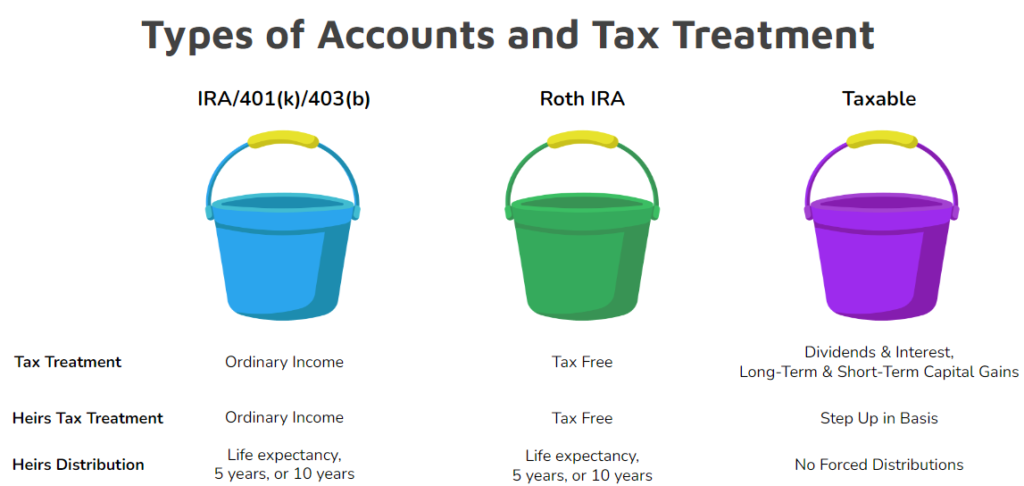

Types of Accounts and Their Taxation

Before talking about who or which organizations should receive what, let’s discuss the types of accounts and their taxation. Once you understand it, the rest will make more sense.

Tax-Deferred

Tax-deferred accounts are accounts such as a 401(k), IRA, or other retirement account. You typically receive a tax-deduction for contributions to the account, earnings grow tax-deferred, and distributions are taxed as ordinary income.

The downside to these types of accounts is that future tax rates are unknown. You know what tax deduction you get today, but you have no idea what tax rate you or your heirs will pay on withdrawals in the future.

When a beneficiary inherits a tax-deferred account, it normally needs to be distributed over the following timelines:

- Within 5 years

- Within 10 years

- Over their lifetime (according to a life expectancy table)

The timeline depends on many factors: who is named as the beneficiary, your age and the beneficiary’s age, when the account was split, and more factors.

If an individual passed away before January 1, 2020, they normally could distribute the inherited account, such as an Inherited IRA, over their lifetime if they were a named beneficiary and the account was put into the Inherited IRA by 12/31 in the year following death.

If an individual passed away after December 31, 2019, new rules apply that a designated beneficiary is required to liquidate the account by the end of the 10th year following death and may need to take annual distributions in years 1 through 9.

There are a few exceptions to the “10-year rule” for eligible designated beneficiaries:

- Surviving spouse

- Disabled individual

- Chronically ill individual

- Minor child

- Individual who is not more than 10 years younger than the account owner

Eligible designated beneficiaries can normally take distributions over their lifetime; however, minor children need to take the remaining distributions within 10 years of reaching age 18.

Distributions from tax-deferred accounts are taxable as ordinary income to heirs.

Although these rules are complicated and were made even more complicated by the SECURE Act of 2019, they are important to understand if you want to optimize the after-tax amount that your beneficiaries can receive.

Tax-Exempt

Tax-exempt accounts are accounts such as a Roth 401(k), Roth IRA, HSA, or other tax-exempt retirement accounts. You don’t receive a tax-deduction for contributions to the account, earnings grow tax-free, and distributions are tax-free.

Similar to tax-deferred accounts, the downside to these types of accounts is that future tax rates are unknown. You know what tax deduction you are giving up today, but you have no idea what tax rate you or your heirs would have paid on withdrawals in the future if you had not contributed to a tax-exempt account.

Tax-exempt accounts allow you to lock in, or prepay, your taxes today in return for tax-free withdrawals in the future, assuming certain conditions are met.

Beneficiaries follow similar rules outlined under the tax-deferred section. They typically need to distribute accounts within 5 years, 10 years, or over their lifetime. Beneficiaries also receive tax-free withdrawals.

The exception to these rules is for HSAs. If a spouse is the beneficiary of an HSA, they can roll the HSA into an HSA in their own name; however, other non-spouse beneficiaries need to fully distribute the account in the year of death, which will be taxable as ordinary income to them. There is no Inherited HSA or the ability to stretch distributions.

Taxable

Brokerage accounts are after-tax accounts. Since you don’t receive a tax deduction and income is not sheltered within it, you pay taxes on it as you go and when you recognize capital gains.

Interest and short-term capital gains in the account are usually taxable as ordinary income in the year they occur, while qualified dividends and long-term capital gains are taxed at long-term capital gains tax rates (0%, 15%, or 20%).

There are no required distributions for heirs. When they receive a brokerage account, they can open an account in their name and often transfer the funds held into their own account.

A major benefit of a taxable account is that heirs often receive a step up in basis when the account holder dies. For example, if the brokerage account had a cost basis of $500,000 and was worth $2,000,000 when the owner died, the cost basis usually “steps up” to the $2,000,000, meaning if the heir immediately sold, there would be little to no capital gains.

There are a few exceptions to this step up in basis rule, such as with irrevocable trusts.

Which Beneficiary Should Receive Which Asset?

Now that you know how your heirs will be taxed, let’s talk about general rules of thumb of who should receive which types of assets.

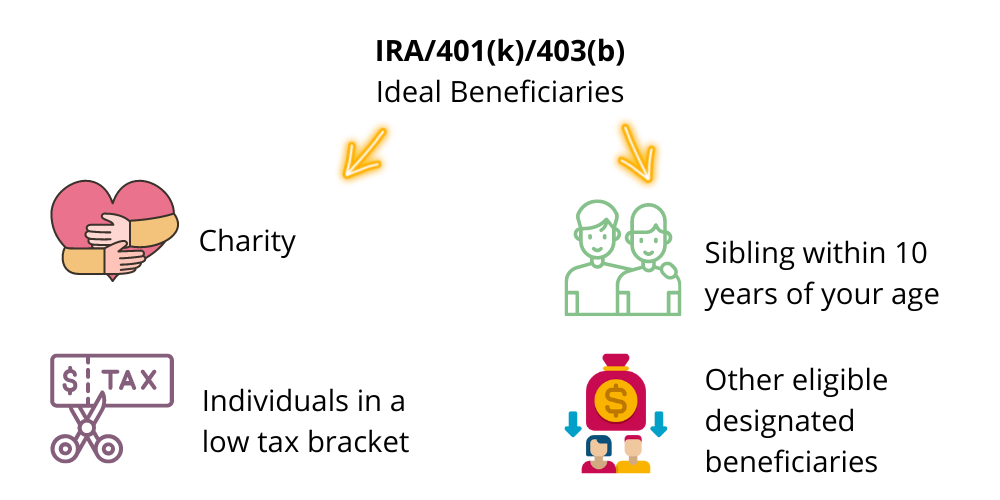

IRA/401(k)/403(b)

Since heirs will pay ordinary income taxes on distributions from a tax-deferred account, these accounts (or a portion of these accounts) are usually best left to charity, if you are already going to give to a charity.

I’ve frequently met people who leave retirement accounts to family members while providing for charities within a Living Will, often using brokerage assets or home proceeds. The problem with this method is that a charity can distribute a tax-deferred account tax-free because they are a charity!

A family member can’t.

It would normally be better for a family member to receive the brokerage asset, which usually receives a step up in basis, and the charity to receive the IRA.

Another heir that would be good to leave a tax-deferred account to is a sibling who is within 10 years of your age or another eligible designated beneficiary. The reason for this is because they have the option to stretch distributions over their life expectancy instead of distributing the account within 5 or 10 years.

This can be particularly powerful for larger retirement accounts because if you are leaving a $1,000,000 retirement account to a beneficiary that has to distribute it within 10 years, that is over $100,000 per year if done equally, which could push them into a much higher tax bracket. If they waited and distributed more of it in certain years, they could be pushed into the highest possible tax bracket!

If an eligible designated beneficiary can stretch those distributions, they may only need to distribute tens of thousands of dollars per year to start, which could keep them in a lower tax bracket.

Whether it makes sense to leave it to an eligible designated beneficiary will depend on the circumstances and tax rates. If you have a sibling who is within 10 years of your age, but are in their highest earning years, the additional income they are forced to take out may still be taxed at high rates.

This is where it is important to do careful planning because if you had a sibling within 10 years of your age who earned significantly less than another sibling, you may want to leave an IRA to them and a Roth IRA to the higher earning sibling, who can take tax-free withdrawals.

To get an idea of how much needs to be distributed each year to a beneficiary, you can use Schwab’s beneficiary calculator.

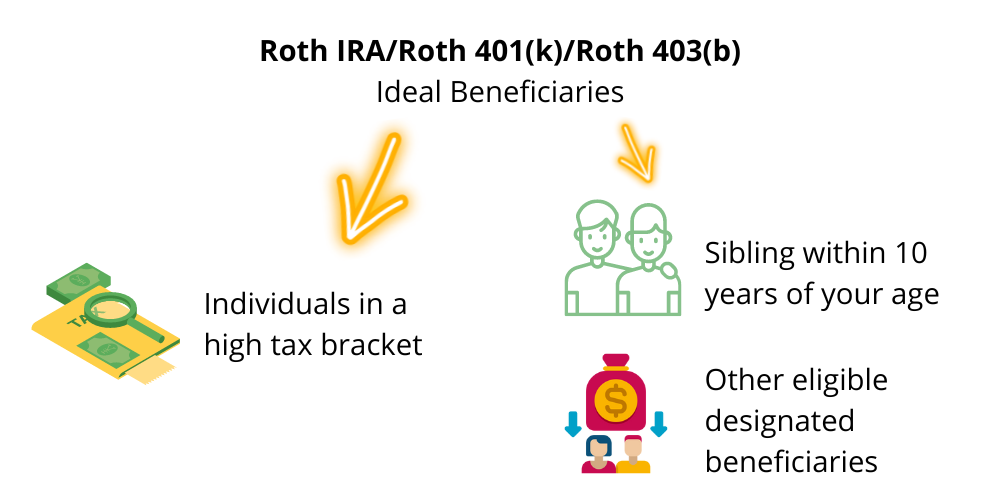

Roth IRA/Roth 401(k)/Roth 403(b)

Since Roth IRAs can be distributed tax-free, they are very beneficial for eligible designated beneficiaries, who can stretch distributions or people in high income tax brackets.

For example, if you have a sibling in a high tax bracket who can stretch distributions over their life expectancy instead of distributing it within 10 years, they may be able to keep money growing tax free for many decades.

Roth IRAs are also very helpful for adult children in a high tax bracket. For example, if you have two kids – one earning a high income and one earning a low income, you may want to consider leaving the Roth IRA to the high earning child and an IRA to the low earning child.

The low earning child may be able to distribute money from the Inherited IRA in the lowest tax brackets, such as 12% or 22%. If the high earning child had to distribute money in their tax bracket, they may pay 35%+, effectively giving them less to spend after taxes. Or, you could split a Roth IRA and IRA, but do it unevenly, such as giving more of the IRA to the low earning child and more of the Roth IRA to the high earning child.

Brokerage Account

Since brokerage accounts often receive a step up in basis at death, they provide flexibility and favorable tax consequences.

Since assets can often be sold shortly after inheriting them for little to no gain, they are often best left to individuals who may need access to a lump sum of money about a year after death. The reason I say about a year after death instead of immediately is that the probate process and distributing the accounts often takes at least 12 months, though it can take longer.

Although certain states allow transfer on death or designated beneficiary designations designed to avoid probate and make distributions easier, they aren’t always the best method for distributing assets. If you have a Living Will with a more complicated distribution structure, a transfer on death designation may blow up the careful planning you did by not leaving enough assets to carry out the plan.

If someone wanted to start a business, pay for an individual’s education, or had another goal that required a lump sum, a brokerage account can be a good option because it doesn’t create as much ordinary income like an Inherited IRA. It also doesn’t have as favorable tax treatment as an Inherited Roth IRA that should often be preserved for as long as possible.

HSA

Normally, your spouse should be the beneficiary of your HSA because they can become the owner of your account after death.

If someone other than your spouse is the beneficiary of your HSA, the account closes on your date of death and the value of the account is taxable as ordinary income to the beneficiary. For example, if you had $50,000 in your HSA when you died, $50,000 would be taxed as ordinary income to the beneficiary.

A beneficiary does have the option to use the HSA to pay the original account owner’s medical expenses incurred within the year of death, which would reduce the amount taxed to them.

Beneficiary Planning for Trusts

Trusts introduce a new element to beneficiary planning. You can make trusts as complicated or as simple as you want. In this section, I’m talking about irrevocable trusts, which usually can’t be changed, except for in extreme circumstances.

Minor Beneficiaries

People often create a trust within their Living Will for minor beneficiaries. Since minor’s can’t receive funds directly, a trust is a way to establish a trustee and trust to manage the money for them and control distributions. Within the trust, you can specify when and how distributions are made.

For example, you could specify that one fourth of the trust is distributed at age 25, another one fourth at age 30, and the remainder at age 35 with stipulations that additional money can be distributed for a home purchase, educational expenses, or starting a business.

You could have the trust last their entire lives to help protect them in the event they are sued (creditor protection) or get a divorce.

You can write your trust almost any way you want.

People Who Struggle with Managing Money

Families also use trusts for people who have trouble managing money. If you have a family member with a substance use problem, poor spending habits, or is easily taken advantage of, a trust could help control the amount of money they receive.

A family member or professional could serve a trustee, who could make regular distributions to pay for housing, groceries, and other necessary expenses, with the flexibility to approve additional expenses as the situation warrants it.

Almost everybody knows at least one person in their life who if they inherited a significant sum of money, would go through it quickly. Trusts can help make sure the money is used prudently.

Taxes and Trusts

The downside to irrevocable trusts is that they usually have worse tax treatment than a normal brokerage account.

Trust tax rates are much higher at lower levels of income. For example, in 2022, irrevocable trusts pay the top tax rate of 37% at $13,450 of income whereas married filing jointly doesn’t pay it until $647,850 of income. What this means is that if the trust is retaining income and not distributing it to the beneficiaries, taxes can eat away at the after-tax returns much more quickly than if they had a normal brokerage account. Some trusts are set up to distribute net income each quarter or year, which may help avoid paying the high trust tax rates because the income would be taxable to the beneficiary once distributed.

Obviously taxes are important, but control over the money is often a more important factor in these situations. It’s usually better to lose 37% of the trust income to taxes if it is not distributed than 100% of the account value to beneficiary misspending.

Examples of How to Choose Beneficiaries and the Tax Consequences

Finally, let’s look at a few common examples of how much beneficiaries will receive after taxes based on receiving different types of accounts.

Let’s say you have $1,000,000 in an IRA, $500,000 in a Roth IRA, $2,000,000 in a brokerage account, and a fully paid off house worth $1,000,000.

You want to leave the following gifts:

- $500,000 to charity

- $500,000 to your two grandchildren, who are age 21

- The remainder to your two adult children, who are age 50 and 52 and earning a high income

There are many different ways to structure how you leave the assets, and there is no perfect answer, but here is one method.

IRA

You can name the charity as a 50% primary beneficiary or have an attorney draft custom beneficiary language that says the charity receives the lesser of 50% of the account or $500,000.

The benefit of structuring it this way is that the charity could distribute their portion from the IRA and receive $500,000. If your adult children or grandchildren did it, they would pay ordinary income taxes on it and receive less.

The remaining 50% you can split equally between your grandchildren if you trust them to receive $250,000 and manage it responsibly. The benefit of them receiving this account as an inheritance is since they are starting work soon, they are in a low tax bracket and may be able to distribute a portion of the account for the next few years in the 12%, 22%, and 24% tax bracket, whereas the two adult children may pay 32% or 35%.

The other option for the grandchildren is to have a trust be the beneficiary of an IRA, so the grandchildren don’t receive the money in one lump sum, but careful planning needs to be followed with a competent attorney to make sure special rules are followed. It will also require trust tax filings and more administrative work for the trustees.

Roth IRA

Each adult child could receive 50% of this account. Since they are in their high earning years, they could take small required distributions in year 1-9 and distribute the remaining account value by the end of the 10th year following death.

This would allow it to compound tax free for nearly a decade.

Brokerage Account

You could leave 12.5% of this account to each grandchild. Since the assets receive a step up in basis at death, there is little tax consequence to them. If you didn’t trust them to receive a lump sum, you could have their share go into a trust and have the parents be trustee. This would give them discretion to follow the rules outlined in the trust.

The remaining portion can go to the adult children equally.

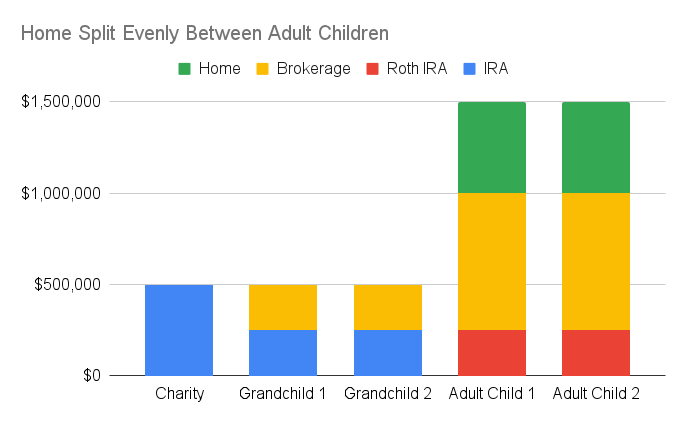

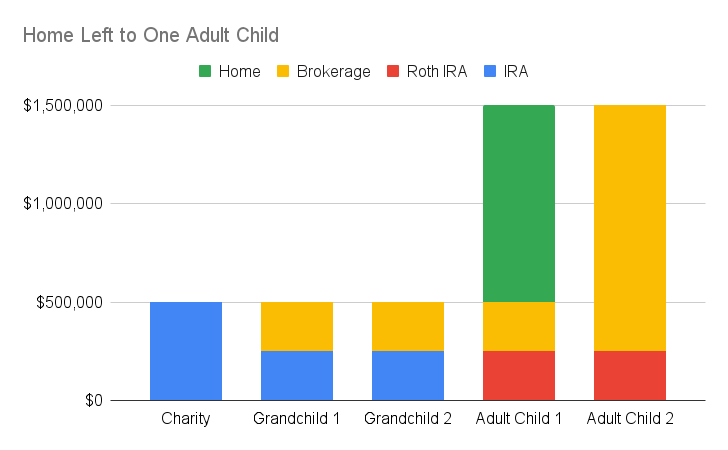

Another method would be to leave 62.5% of this account to one adult child and 12.5% to the other adult child and leave the home to one child, instead of splitting the home equally. You could give a little more than 12.5% of the brokerage account to make up for any selling expenses and commissions with the home sale.

The benefit of this method is that one child can make decisions about the house. Brokerage assets are much easier to split and make decisions about than a home. Homes are often a source of tension as heirs try to answer the following questions:

- Should we sell the home?

- How much should we sell it for?

- Should we renovate and put money into it before selling?

- Who do we hire to sell it?

- When should we sell it?

- Should we rent the home?

- What should the monthly rent be?

- Should we hire a property maintenance company?

- If not, how much should we pay the heir managing the property?

- How should we split maintenance costs?

- What if one person wants to put more labor into the property while another wants to hire for projects?

Properties are often a source of stress and require careful planning when owned by more than one person. For certain families, splitting assets unevenly to give property to one individual can help ease the burden.

Home

You could split the home evenly between the adult children, but as mentioned before, you could give the home to one child and make up the difference with the brokerage assets.

Since the home and brokerage assets may have a step up in cost basis at death, the major difference if both heirs want to liquidate is that the home will have selling expenses and commissions. You may want to account for those in the brokerage split.

For example, if the selling costs and commissions are 8% of the home value, you could give $80,000 more of the brokerage account to the child receiving the home than you were originally planning to make it as close to even as possible.

Summary of Asset Split

As you can see, splitting assets is complicated.

If you give outright percentages, you may need to revisit it frequently as asset values go up and down and withdrawals are made.

The other option is to write custom beneficiary language to account for more circumstances and changing asset values, but even those come with their own challenges, such as whether a custodian will accept them.

How you split accounts can make a huge difference in the after tax amounts beneficiaries receive. For example, if you left $500,000 to a charity in your Last Will and use brokerage assets for it, that would mean $500,000 of the IRA may have gone to the adult children. If they paid a marginal tax rate of 32% on the distributions, they would each receive $170,000 after taxes instead of the full $250,000 they received from the brokerage assets.

That’s a difference of $80,000 lost to taxes!

This is one minor example of how choosing beneficiaries with taxes in mind can make a huge difference.

Final Thoughts – My Question for You

Although splitting accounts evenly among beneficiaries may seem like the easy and simplest action to take, it can leave beneficiaries with less money.

Since accounts and property have different tax treatment, choosing your beneficiaries based on their tax rates and how they may need to take distributions can help enhance their after-tax wealth.

Similar to how you likely want to minimize taxes during your lifetime, you may want to minimize taxes for your heirs.

Estate planning and choosing beneficiaries is complicated and filled with many “what if” scenarios, which is why it’s important to acquire the knowledge yourself and work with a competent estate planning attorney or hire a team to support you, such as a financial planner, accountant, and estate planning attorney that can coordinate strategies on your behalf.

I’ll leave you with one question to act on.

Does your estate plan optimize taxes for your beneficiaries?

About the Author

Elliott Appel, CFP®, CLU®, RLP®, is a Financial Planner and Founder of Kindness Financial Planning, LLC, a fee-only financial planning firm located in Madison, WI that works virtually with people across the country. Kindness Financial Planning is focused on helping widows, caregivers, and people affected by major health events organize and simplify their financial lives, do proactive tax planning, and make sure insurance and estate planning is coordinated with smart investment advice.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Elliott's Find an Advisor Profile.

Share this

- Good Financial Reads (924)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

What is Asset Location and How Can It Reduce Taxes?

.png)

The Ultimate Roth IRA Guide