These Related Stories

The Ultimate Roth IRA Guide

Share this

.png?width=554&name=BLOG%20IMAGES%20TEMPLATE%20(10).png)

10.0 MIN READ

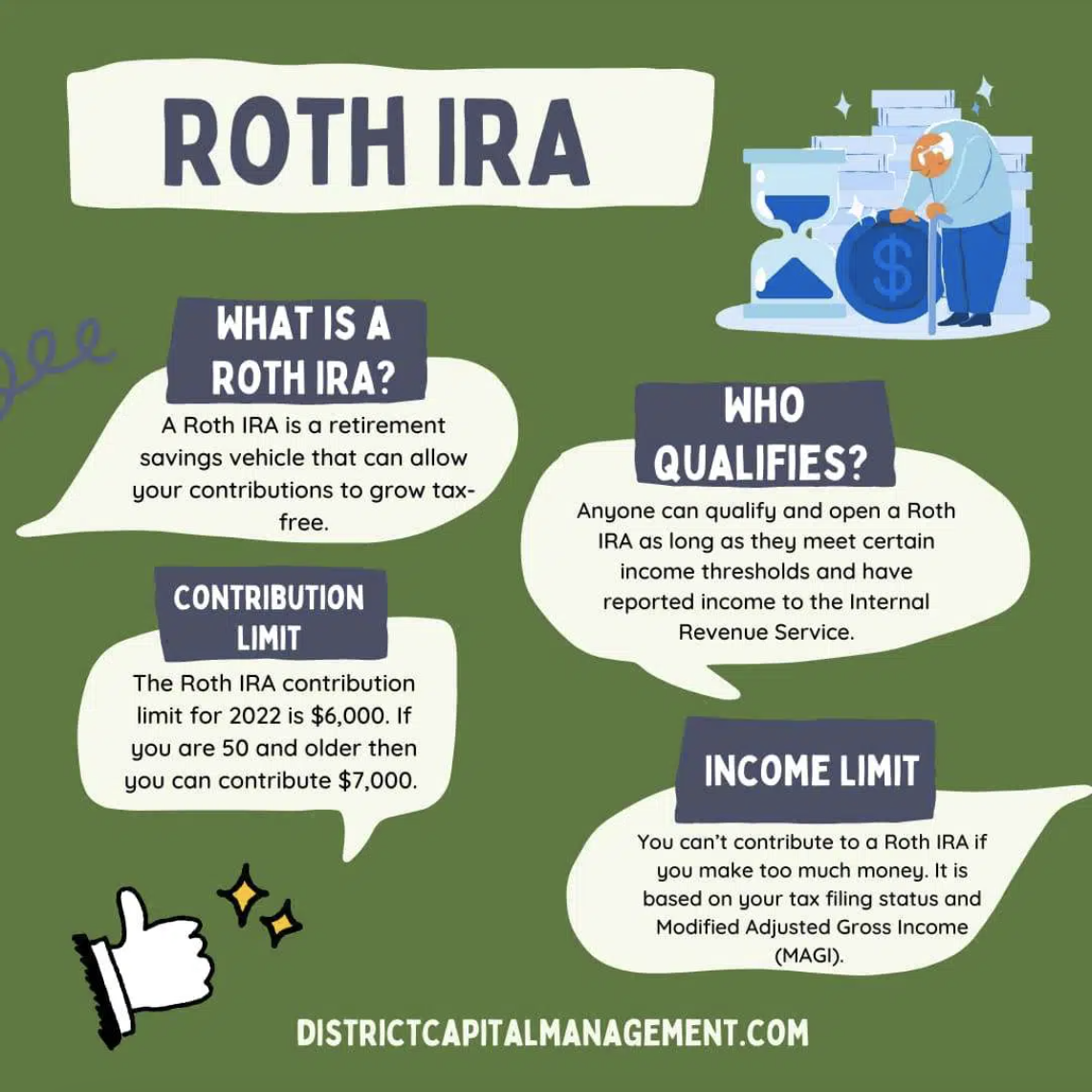

Are you trying to decide which retirement savings plan is best for you? A Roth IRA is a retirement savings vehicle that can allow your contributions to grow tax-free. There are several benefits to a Roth IRA. It is most beneficial for those who are currently in a relatively low or mid tax bracket, and will likely be in a higher tax bracket later in life.

There is no age limit to open a Roth IRA, but it is very beneficial the younger you start. Through leveraging the power of compound interest, you can potentially reap a steady stream of tax-free income during retirement! In this blog, we will explore the Roth IRA in greater detail so you can decide for yourself if it’s the right retirement savings plan for you.

What is a Roth IRA?

A Roth IRA is an individual retirement account (IRA) in which money grows tax-free. It was established in 1997. The contributions are not tax-deductible but all future withdrawals are tax-free. There are currently no required minimum distributions, provided the account holder is alive and has not passed on the Roth IRA to a beneficiary after his/her death.

Who Qualifies for a Roth IRA?

Anyone can qualify and open a Roth IRA as long as they meet certain income thresholds and have reported income to the Internal Revenue Service. For example, some teenagers with part-time jobs could open a Roth IRA but a teenager who is getting cash for cleaning backyards cannot. A 75-year old lawyer who is working part-time can still be eligible for a Roth. There is no age limit to open a Roth IRA.

If you are a non-working spouse or a spouse with low wages, then you may also qualify for a spousal Roth IRA. A Roth IRA is generally best if you think your taxes will be higher in retirement than what they are now.

How Much Can You Contribute to a Roth IRA in 2022?

The Roth IRA contribution limit for 2022 is $6,000. This is unchanged from 2021. If you are 50 and older then you can contribute $7,000. The contributions for a tax year must be made by the IRA owner’s tax filing date. This date is generally April 15 the following year. For example, to contribute towards tax year 2021, one has until April 18th, 2022 this year to do so.

You must have earned income to be eligible for a Roth IRA. This includes salaries, bonuses, commissions, consulting gigs, and small business income. It is generally any amount that is shown in Box 1 on the individual’s Form W-2 or on a 1099.

What are the Roth IRA Income Limits for 2022?

You can’t contribute to a Roth IRA if you make too much money. The income limit has increased for 2022 so that means that more Americans can now contribute to a Roth IRA. Based on your tax filing status and Modified Adjusted Gross Income (MAGI), the table below specifies how much you can contribute to a Roth IRA.

Amount of Roth IRA Contributions You Can Make in 2022

| If your filing status is... | And your modified AGI is... | Then you can contribute... |

|---|---|---|

| married filing jointly or qualifying widow(er) |

< $204,000 |

up to the limit |

| married filing jointly or qualifying widow(er) |

> $204,000 but < $214,000 |

a reduced amount |

| married filing jointly or qualifying widow(er) |

> $214,000 |

zero |

| married filing separately and you lived with your spouse at any time during the year |

< $10,000 |

a reduced amount |

| married filing separately and you lived with your spouse at any time during the year |

> $10,000 |

zero |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year |

< $129,000 |

up to the limit |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year |

> $129,000 but < $144,000 |

a reduced amount |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year |

> $144,000 |

zero |

What are the Benefits of a Roth IRA?

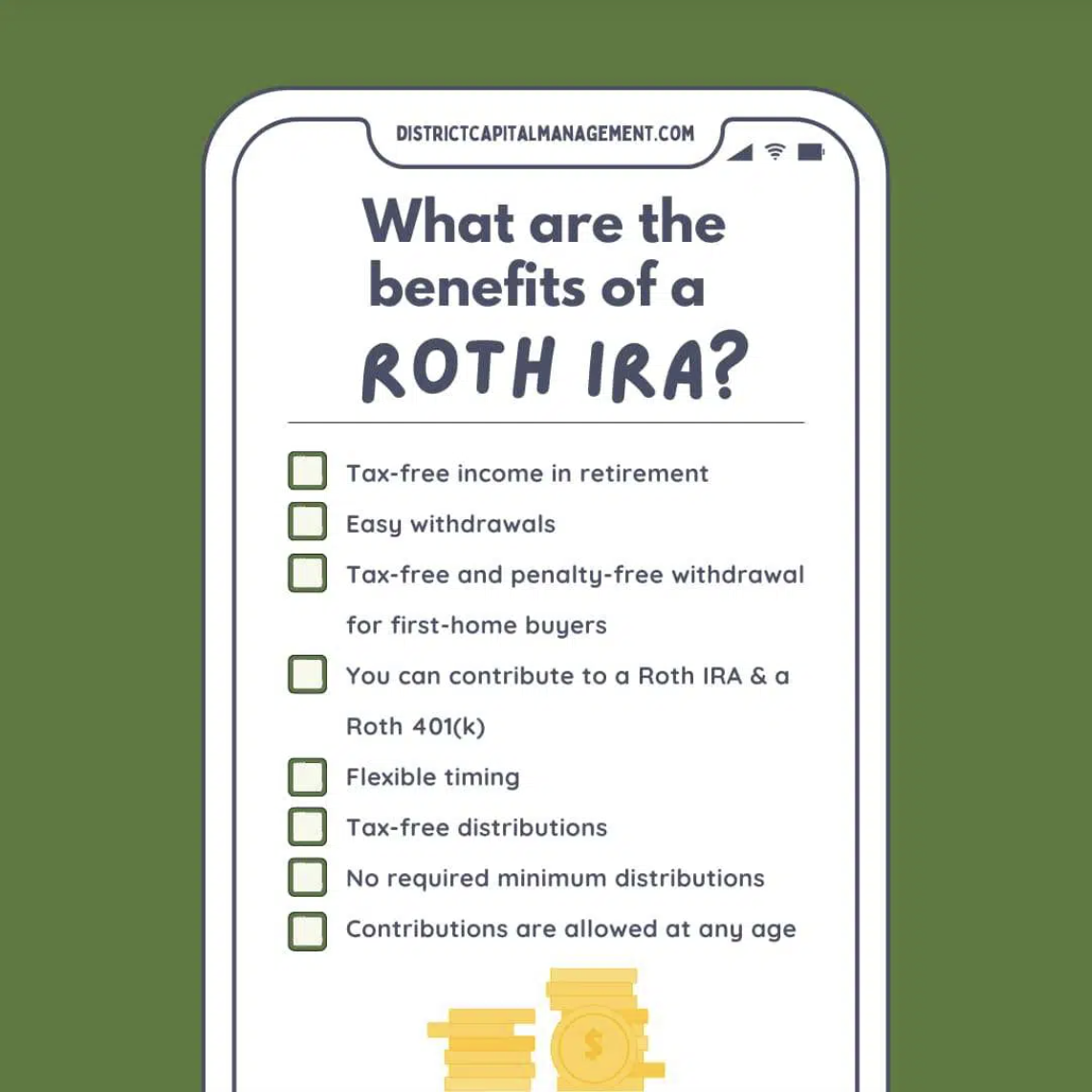

- Tax-free income in retirement: Since you pay the taxes up-front, you can make tax-free withdrawals during retirement. This is a major advantage. If you decide to take one large lump sum, then you don’t have to worry about being bumped up to a higher tax bracket.

- Easy withdrawals: you can withdraw the money that you contributed at any time without any penalties or taxes.

- Tax-free and penalty-free withdrawal for first-home buyers: You can withdraw up to $10,000 of earnings from your Roth IRA without paying income tax or the early withdrawal penalty if you use the money for the purchase of your first home.

- You can contribute to a Roth IRA as well as a Roth 401(k): If your income allows, then you can contribute to both.

- Flexible timing: You can choose to contribute to your Roth IRA whenever it suits you. If you are ahead in your savings, you could contribute the full $6,000 on the first day of the year.

- Tax-free distributions: once you hit 59 ½ and have been contributing to a Roth IRA for at least 5 years, then you can make tax-free withdrawals of your earnings.

- No required minimum distributions: Roth IRAs are exempt from RMDs. This means that you can leave the money in your Roth to pass on to heirs or a charity if you choose.

- Contributions are allowed at any age: You can continue to contribute to a Roth IRA for as long as you like (as long as you meet income eligibility requirements)

What are the Disadvantages of a Roth IRA?

The major disadvantage of a Roth IRA is that they do not include an up-front tax break. This is also the major difference between a Roth IRA and a pre-tax 401(k). There is also no automatic payroll deduction so you need to make sure that you remember to contribute each year.

Roth IRA vs Traditional IRA

The two major differences between a Roth IRA and a Traditional IRA are taxes and withdrawals.

Taxes:

– A traditional IRA is ideal for those who want an immediate tax break as contributions can be tax-deductible. However, you do have to pay taxes when you withdraw the money.

– A Roth IRA is a good choice if you’re not eligible to deduct traditional IRA contributions, or if you want tax-free growth on your investments. You do not have to pay taxes on your withdrawals.

Withdrawals:

– For a traditional IRA, you cannot take out the money before you’re 59 ½ years old. If you do then you’ll incur a 10% penalty and have to pay federal and state taxes.

– For a Roth IRA, you can take out any contributions that you have made without paying any taxes. However, this only applies to your contributions, not your earnings.

If you expect your tax bracket to be higher in retirement, then a Roth IRA is usually more beneficial for you. Younger and lower/middle income individuals may benefit from a Roth IRA most.

Roth IRA vs Roth 401(k)

There are some major differences between a Roth IRA and a Roth 401(k) as outlined below.

-

Income limits: Roth IRAs have income limits and Roth 401(k)s do not.

-

Contribution limits: For 2022, a Roth IRA has a maximum yearly contribution limit of $6,000 with an additional $1,000 catch-up contribution ($7,000 total) if you’re age 50 or olders. The Roth 401(k) contribution limit is $20,500 with an additional $6,500 catch-up contribution ($27,000 total) if you’re 50 or older.

- Required minimum distributions: Roth IRAs do not have required minimum distributions. You can leave the money growing tax-free for as long as you wish. Roth 401(k)s do have required minimum distributions.

-

Early withdrawals: For a Roth IRA, you are allowed to take out only your contributions anytime with no penalty and no tax. Early withdrawals for a Roth 401(k) can get messy. Generally, if your employer allows for in-service withdrawals then you can access your contributions tax and penalty-free. However, if you take the earnings out, you may have to pay income tax as well as a 10% penalty. The problem with taking money from a Roth 401(k) is that early withdrawals are pro-rated and will be considered partially your contributions and partially your earnings.

You can contribute to both a Roth IRA and a Roth 401(k) if your income allows. It’s best to speak with a certified financial advisor who can help you decide if contributing to both is best for your financial situation and goals.

Spousal Roth IRA

A non-working spouse can contribute to a Roth IRA, as long as their household income meets the eligibility limit. These contributions are subject to the same rules and limits as regular Roth IRA contributions. This Roth IRA account will be separate from the working spouse’s Roth IRA account as Roth IRAs cannot be joint.

Roth IRA Withdrawal Rules

There are Roth IRA withdrawal rules that you must follow. You can withdraw your Roth IRA contributions at any time without owing any penalties or taxes. Qualified withdrawals of earnings can be tax-free and penalty-free but it does complicate things with the IRS. Be careful doing this because you can be taxed if those withdrawals do not meet the ‘qualified’ definition.

People who have had their Roth IRAs for at least 5 years and are at least 59½ years old can withdraw contributions and earnings without paying federal taxes.

Withdrawals that are not ‘qualified’ will be subject to income tax and/or a 10% early distribution penalty. There are some exceptions which include childbirth/adoption expenses, qualified higher education expenses, and medical insurance.

The 5-Year Rule

The withdrawal of Roth IRA earnings may be subject to income taxes and a 10% early withdrawal penalty depending on your age and if you have met the five year rule. The five year rule means that you need to have contributed to a Roth IRA for at least 5 years.

If you meet the five year rule:

- Under age 59½: Earnings are subject to taxes and penalties. You may be able to avoid taxes and penalties if you use the withdrawal for a qualified expense.

- Ages 59½ and older: No taxes or penalties.

If you don’t meet the five-year rule:

- Under age 59½: Earnings are subject to taxes and penalties. You may be able to avoid the penalty (but not the taxes) if you use the money for a qualified expense.

- Ages 59½ and older: Earnings are subject to taxes but not penalties.

Opening a Roth IRA

A Roth IRA can be established with any institution that has approval from the IRS to offer a Roth IRA. This includes banks, brokerage firms, credit unions and loan associations.

There are two documents that need to be read/signed by the IRA owner to establish a Roth IRA. These include:

- The IRA disclosure statement

- The IRA adoption agreement and plan document

Backdoor Roth IRA

If your income is too high and you are ineligible to open a Roth IRA, you may still be able to contribute via a backdoor Roth IRA. A backdoor Roth IRA involves putting money into a traditional IRA, and then converting that account to a Roth IRA. In any year, you can convert as much of your traditional IRA to a Roth IRA as you want, as long as you pay the taxes on the earnings. There are several steps that need to be done to execute a backdoor Roth properly. If you want to learn how to do a Backdoor Roth IRA, check out our blog.

Common Roth IRA questions:

-

Can you have more than one Roth IRA?

Yes, you can have more than one Roth IRA. However, the combined contributions must not exceed the $6,000 ($7,000 for those aged 50 and older) contribution limit for 2022.

-

Can you contribute to a Roth IRA and a Roth 401(k)?

Yes, you can contribute to both a Roth IRA and a Roth 401(k).

-

How much money do you need to start a Roth IRA?

While there are maximum contributions to a Roth IRA each year, there are no minimum contributions. This means that if you want to contribute only $100 to start your Roth IRA, then you can (as long as you don’t make over the income limit). Some providers may require you to contribute more but you will be able to find some that will let you only contribute $100.

-

Can you lose money in a Roth IRA?

Yes, you can lose money in a Roth IRA. This is due to market fluctuations, not leaving the money in the account long enough to compound and early withdrawal penalties. However, if you look at it as a long term investment, then a Roth IRA is a great retirement savings plan.

-

What are some types of funds that aren’t eligible for a Roth IRA?

Some types of funds that aren’t eligible include rental income, interest income, stock dividends and pensions.

-

How much should I put in my Roth IRA monthly?

If you want to max out your contributions for 2022, then you will contribute about $500 monthly. This amount will increase to around $583 monthly for individuals aged 50 and older.

-

Can you use a Roth IRA to fund a house purchase?

Yes, you can use a Roth IRA to fund a house purchase. You can withdraw your direct contributions at any time for any reason. You may be able to withdraw up to $10,000 of your earnings that can be used towards the purchase of your first home.

-

What happens if I inherit a Roth IRA?

If you are a spouse that has inherited a Roth IRA then you are never required to take minimum distributions. However, the SECURE Act recently changed the rules for non-spousal heirs. Non-spousal heirs are required to take minimum distributions and all of the funds must be liquidated within 10 years of the original account owner’s death.

One thing to keep in mind is that the withdrawals are tax-free. This means that if you have inherited a Roth IRA and you wait until the 10th year to liquidate the money, then you will benefit from all of those additional years of tax-free growth.

Who can help me make decisions about my Roth IRA?

Roth IRA is a great retirement savings plan for you to consider since there are no required minimum distributions and you withdraw the money tax-free. A financial planner can help you decide if it is the right choice for you. Whether you want to open a Roth IRA, max it out, or if you are changing jobs or a combination of all of these, we are here to help guide you.

About the Author

About the Author

Alvin Carlos is the founder of District Capital Management, an independent, fee-only financial planning firm. He helps professionals and entrepreneurs in their 30s and 40s elevate their finances and maximize their money.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Alvin's Find an Advisor profile.

Share this

- Good Financial Reads (924)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

7 Things to Consider Before Tax Day Arrives

Capital Gains vs. Ordinary Income – The Differences + 3 Tax Planning Strategies

.png)