These Related Stories

How Much Umbrella Insurance Do I Need?

Share this

11.0 MIN READ

Umbrella insurance is one of the least talked about insurances, which is highly problematic.

Umbrella insurance is an important risk management tool, particularly for people who have wealth, income, or future income potential.

Plus, it’s cheap relative to most other types of insurance!

I’m always amazed at the number of people who forgo umbrella insurance or have low limits of umbrella insurance coverage when it could potentially protect your financial future from our lawsuit-happy society.

Whether you already have umbrella insurance or decided not to buy it, this article is for you. It will help you better understand why umbrella insurance is important, what it covers, and what it doesn’t cover. It will also help answer the question of “do I need umbrella insurance?”, help you decide how much umbrella insurance to purchase, and give you an idea of how much you may pay.

What is Umbrella Insurance?

Umbrella insurance is additional insurance that provides extra protection on top of your other policies, such as auto, home, and watercraft insurance.

Auto, home, and watercraft insurance have certain limits in how much will be covered, and umbrella insurance provides extra insurance beyond those limits. Said another way, when those limits are exhausted, umbrella insurance could cover claims in excess of those limits.

It can provide extra coverage for lawsuits, injuries, and property damage.

For example, if you are in an auto accident where you are at fault and you are sued, an umbrella insurance policy could help pay for an attorney to defend you and pay for liability claims if your auto insurance limit is reached.

Or, if a guest is over at your house, falls, and sues you for medical bills and lost wages above your homeowner’s liability limit, an umbrella insurance could help cover the bills, lost wages, and attorney’s fees to defend the lawsuit.

Umbrella insurance is what could pay out when your other limits are exhausted, and it can pay for attorneys to defend you.

Why Umbrella Insurance Is Important

Umbrella insurance is important because many homeowners, auto, and watercraft insurances only provide limits up to a certain amount – often $500,000. Plus, we live in a litigious society.

How many times have you heard about a ridiculous lawsuit and rolled your eyes?

I know I have plenty of times. Yet, someone is paying for at least one attorney to defend them from those claims.

Even if it is a reasonable lawsuit, there are situations where $500,000 is not going to be enough to cover a claim.

For example, if you cause an accident that damages multiple cars and injures multiple people, $500,000 may be nowhere close to enough.

Imagine hitting a few higher-end vehicles and injuring a few people who make hundreds of thousands of dollars per year. Depending on the price of the vehicles, you may exhaust your property damage quickly. If those individuals are out of work for more than a year, $500,000 likely isn’t going to be enough protection.

Umbrella insurance sits on top of your other policies to provide another layer of protection.

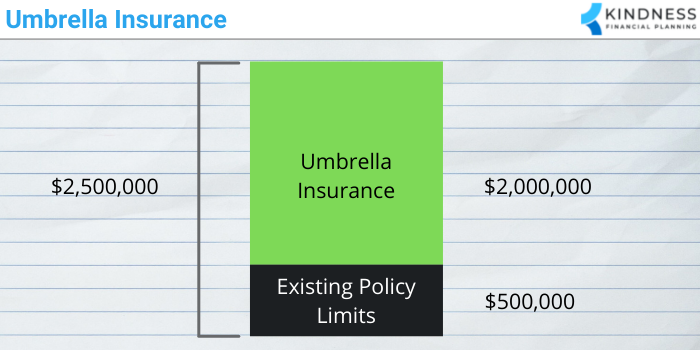

For instance, if you had personal liability coverage of $500,000 and a $2,000,000 umbrella insurance policy, your $500,000 of personal liability coverage would be used first and then up to $2,000,000 of additional coverage.

This means you would have a total of $2,500,000 of personal liability coverage.

It’s low odds you’ll ever need to use the coverage, but if you do, it could mean the difference between starting over financially and keeping your same lifestyle.

What Does Umbrella Insurance Usually Not Cover?

Umbrella insurance doesn’t cover everything. It picks up where your other limits leave off, which means if your auto, homeowners, or watercraft coverage don’t include coverage for something, your umbrella insurance likely won’t either.

As with anything, read the fine print and ask your insurance agent lots of questions to understand what it will and won’t cover.

Commonly, it won’t cover:

- Business activities

- Serving on a board

- Intentional acts

- Criminal acts

- Your injuries

- Damage to your personal property

- Other exclusions in your policy (i.e. injuries or property damage caused by certain dog breeds, certain vehicles, certain activities, etc.)

Umbrella coverage usually does not cover business activities. For example, if a client visits you at your home for business purposes, falls, and has to go to the hospital for serious injuries, your umbrella insurance, and likely your homeowner’s insurance, is not going to cover it. You usually need specific business insurance coverage.

Any intentional or criminal acts to cause damage are usually not covered. For example, if you get angry and punch your grandkids’ soccer coach, the umbrella insurance probably isn’t going to help cover your lawsuits or injuries.

Umbrella insurance also doesn’t protect your personal property. If your prized artwork at home is damaged, your homeowners insurance, and usually a specific rider on your policy is needed, is likely going to provide coverage – not your umbrella insurance.

Something that commonly comes up is that umbrella insurance usually does not cover you serving on the board of a company, condo association, or non-profit. Usually, you need to add an endorsement or obtain directors and officers coverage.

You also need to be aware of other exclusions in your policy. For example, certain dog breeds may be excluded from an umbrella insurance policy. If you owned a dog breed specifically excluded in the policy, and it bites someone, you may not have protection.

Read the fine print. Ask your agent lots of questions. You don’t want any surprises about what will be covered.

Do I Need Umbrella Insurance?

The key question is: “Do I need umbrella insurance?”

If only we all knew with certainty!

Do any of us really need auto, homeowners, or watercraft insurance?

If we never have an auto accident and it wasn’t legally required in many states, one could argue auto insurance was never needed.

The same goes for homeowners insurance. If nobody is ever injured at your house, it never burns down, and nothing ever goes wrong, one could argue homeowners insurance was never needed.

It’s the same for watercraft insurance.

Unfortunately, that’s not how life or insurance works.

Insurance exists to help protect you from low probability, high-loss events, such as your home burning down.

Statistically speaking, the odds of needing to use umbrella insurance is low, but if you need it, you often really need it.

I can’t say for certain whether you need umbrella insurance, but if you have high income, expect to have high income in the future, or have significant assets, those are good reasons to own an umbrella insurance policy.

Example of Why Umbrella Insurance is Important

Think about it from the perspective of a personal injury attorney.

Let’s say you just hit someone with your car, and they hire a personal injury attorney to sue you. The attorney finds out you live in a nice neighborhood in an expensive home. They also find out you worked as an executive at a company for a number of years. They drive by your house and see expensive cars in your driveway.

Cha-ching.

The personal injury attorney is excited about suing you now. They know, or at least believe, you have assets that could be won in a lawsuit.

If you don’t have a nice home, good income, or expensive cars, the personal injury attorney may not take the case. You can sue, but if there are no assets or income to win, there is no point for the personal injury attorney to take the case.

Common Mistake in Deciding Whether to Get Umbrella Insurance

One of the common mistakes people make in deciding whether to purchase umbrella insurance coverage is only looking at their net worth.

I’ve heard many people recommend getting umbrella insurance equal to one’s net worth; however, this is a mistake.

For example, if your grandkid is a doctor who is in their residency making around $60,000 a year and has a negative net worth because of student loans, conventional wisdom would say not to have an umbrella insurance policy.

But, doctors have high income potential. Let’s say your grandkid wants to go into anesthesiology and plans to make $500,000 a year in a few years.

Let’s go back to the personal injury attorney example.

The personal injury attorney does some digging after your grandkid injures someone in a car accident. They find out your grandkids specialty because it’s listed online. They know anesthesiologists make a high income.

They may not have sued because of the negative net worth, but the earning potential is lucrative, even if they are not making it yet.

They decide to sue and 25% of their wages are garnished in the future until the personal injury settlement is paid.

This is why it’s important to take into account current income, future earning potential, and net worth when deciding to get umbrella insurance.

Below are a few scenarios where it could make sense to have an umbrella insurance policy:

- Own a home

- Own a rental property

- Have high income or expect to in the future

- Have savings and assets

- Worried about lawsuits

- Have kids

- Own a dog

- Have a trampoline, pool, or other high risk structure

- Entertain people in your home

- Have more publicly available information about yourself

- Participate in activities that are more likely to injure others (ski, surf, hunt, etc.)

If you are reading this, there is a good chance you would benefit from having an umbrella insurance policy.

It’s cheap and can provide extra peace of mind.

How Much Umbrella Insurance Do I Need?

Once you’ve decided you need umbrella insurance, the next question is, “How much umbrella insurance do I need?”

As you may have suspected, it’s not a straightforward answer.

Common Rule of Thumb of How Much Umbrella Insurance Is Needed

A common rule of thumb people throw around is an amount equal to your net worth, so if your net worth was $2,000,000, you would get a $2,000,000 umbrella insurance policy.

Although not a terrible way to approach the decision, you saw how that can be problematic for people with a low net worth today who have high future earning potential.

It’s also problematic because people can still sue for more than your net worth.

For example, if a child were hit in an auto accident and became a quadriplegic, they are likely going to require very expensive care for the rest of their life.

They may be less willing to settle a case than other types of injuries because they are going to need more financial support for longer.

How much umbrella insurance you need comes down to how much you are willing to risk.

Amounts of Umbrella Insurance That Can Be Purchased

Many insurance companies will offer amounts between $1,000,000 and $5,000,000, with some going up to $10,000,000. Some of the higher end carriers will offer umbrella insurance amounts above $10,000,000.

Since umbrella insurance is relatively inexpensive compared to the coverage available, I usually err on the conservative side and go for higher amounts.

For example, if someone had a net worth of $5,000,000 and was retired, I would look at the cost difference between a $5,000,000 umbrella insurance policy and a $10,000,000. The $10,000,000 umbrella insurance policy is usually very reasonable.

Why Higher Amounts of Umbrella Insurance Can Be Helpful

The more coverage you can put between your assets and someone suing you, the less likely someone will be able to reach your assets.

For example, if you have a $5,000,000 policy and a personal injury attorney thinks you might have $3,000,000 in assets, they may be more interested in settling with the insurance company for an amount less than $5,000,000 if it can avoid a long, drawn out court battle. Personal injury attorneys usually go after the easier money.

Another aspect to keep in mind is that an umbrella insurance policy means you have attorney’s fighting on behalf of the insurance company to help prevent a large payout. For example, if you have a $5,000,000 umbrella insurance policy, those attorney’s are going to work incredibly hard to prevent someone from successfully suing for $5,000,000, let alone amounts above that.

Knowing an attorney provided by the insurance company is going to defend a lawsuit may be enough of a reason to get umbrella insurance coverage. Attorney fees are not cheap.

Something to be aware of is that some insurance carriers use your umbrella insurance limits to hire and pay an attorney to defend you while others pay attorney fees outside of your limits.

This is important to be aware of because if your attorney’s fees are deducted from your umbrella insurance limits, you may have less than you think. For instance, if your attorney’s fees amount to $200,000 and you have a $1,000,000 umbrella insurance policy, you only have $800,000 worth of coverage left.

For most people, the peace of mind offered by having a little extra umbrella insurance can outweigh the incremental cost.

How Much Does Umbrella Insurance Cost?

Umbrella insurance is relatively inexpensive because the odds of using it are low. It’s normally sold in increments of $1,000,000. The first $1,000,000 is usually the most expensive and then each incremental $1,000,000 is cheaper.

For example, the first $1,000,000 might cost $150-$350 a year and then each additional $1,000,000 of coverage might be $75-$150 a year.

Below is an example of what various amounts might cost.

| Umbrella Insurance Coverage | Example of Annual Cost |

| $1,000,000 | $150-$350 |

| $2,000,000 | $225-$500 |

| $3,000,000 | $300-$650 |

| $4,000,000 | $375-$800 |

| $5,000,000 | $450-$950 |

| $10,000,000 | $825-$1,700 |

Costs will vary depending on state, risk factors, and other variables. For example, if you have a pool, multiple teenage drivers, and a dog, your cost may be more than someone without a pool, kids, and a dog.

You should ask your insurance agent for a quote to determine what it would actually cost you.

Normally, you purchase an umbrella insurance policy from the same insurance carrier as your auto and homeowner’s policy, but if you can’t get one from them, you could consider a standalone policy.

The key is to make sure your underlying limits are high enough in coordination with the umbrella policy. Most insurance carriers will only offer an umbrella policy if you have a certain amount of underlying coverage on your home, auto, or watercraft policy.

Below are a couple carriers that may offer a standalone umbrella insurance policy:

Umbrella insurance is very inexpensive relative to the coverage it provides. For a few hundred dollars per year, you could add millions of dollars of extra coverage.

Final Thoughts – My Question for You

Umbrella insurance can be a key coverage for financial peace of mind.

Although many people don’t have it, consider what would happen if you got in an accident tomorrow and injured someone.

Would your existing coverage be enough?

What would it feel like if you needed to hire an attorney to defend you from a lawsuit?

What would happen if you faced a personal injury settlement for millions of dollars?

Umbrella insurance can help in a variety of situations and is inexpensive. For a few hundred dollars per year, you could add extra protection and potentially sleep better knowing everything you have worked for is better protected.

While you are at it, don’t forget to protect your credit.

I’ll leave you with one question to act on.

Will you change the amount of umbrella insurance coverage you have?

About the Author

Elliott Appel, CFP®, CLU®, RLP®, is a Financial Planner and Founder of Kindness Financial Planning, LLC, a fee-only financial planning firm located in Madison, WI that works virtually with people across the country. Kindness Financial Planning is focused on helping widows, caregivers, and people affected by major health events organize and simplify their financial lives, do proactive tax planning, and make sure insurance and estate planning is coordinated with smart investment advice.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! Find an Advisor.

Share this

- Good Financial Reads (925)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

Life Insurance

.png)

Disability Insurance: Use This Process to Help Determine What You Need (and What You Don’t)