These Related Stories

Is the Housing Market Going to Crash?

Share this

8.0 MIN READ

The last 28 months have been a rollercoaster. Economic conditions have shifted from one side of the ship to the other faster than anything we’ve seen historically. The housing and real estate market is undergoing one of those shifts right now. Given the popularity of home ownership and owning rental properties it’s important to understand how much things have changed since the start of 2022. The key question on everyone’s mind: is the housing market going to crash? Let’s look at what’s going on.

Current Home Price Trends

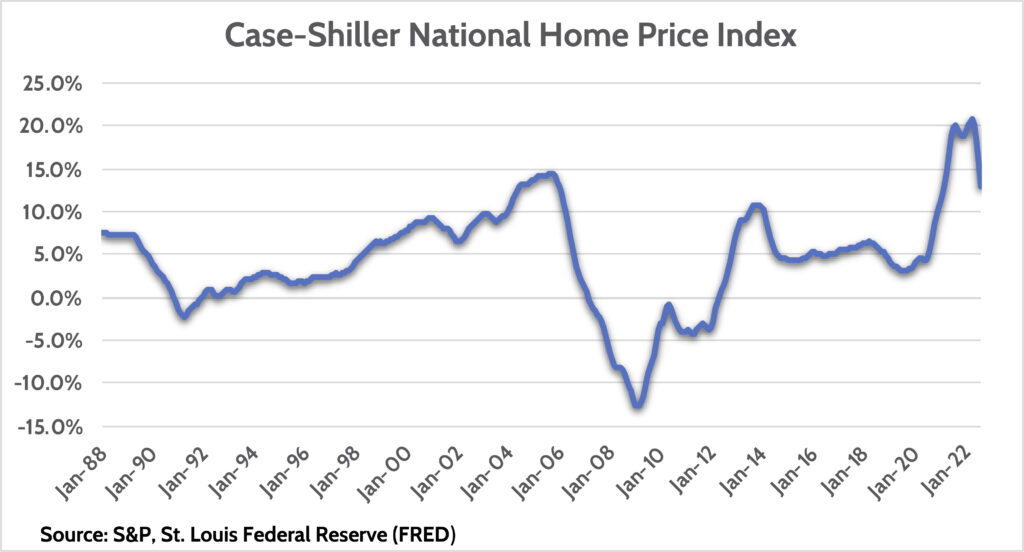

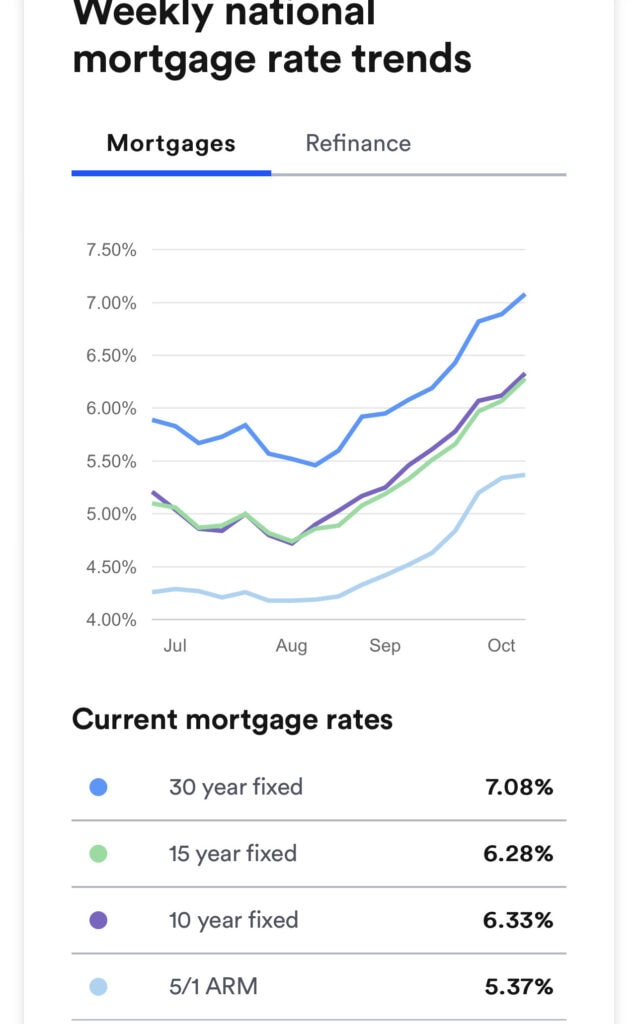

The housing market has been on fire since the onset of the pandemic. Plunging mortgage rates to below 3% were the driver of that trend. Mortgage Rates started rising quickly early in 2022, but home prices were holding until recently.

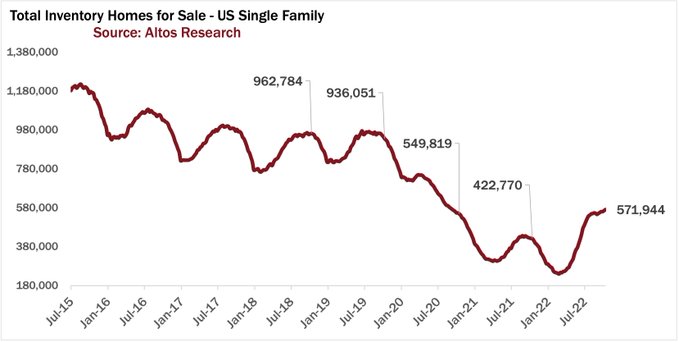

Even with the recent cooling, home prices were still +13% year-over-year in August. But that’s deceiving. Two timely measures of home buying activity show a clear slowdown. One is the inventory of homes for sale. While still well below normal levels, there’s been a clear increase in homes for sale in recent weeks, and we’re seeing rising inventories at a time of year when they normally fall.

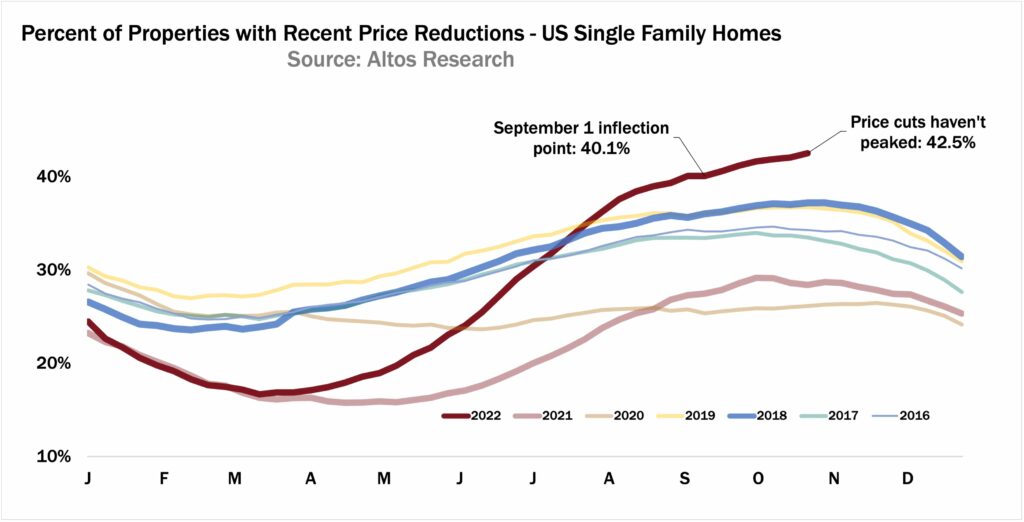

The second indicator showing a cooling market is the number of homes for sale that are cutting prices. Price cuts largely disappeared in 2021 and early 2022 as cash buyers and low rates forced home buyers to “bid up” to get the house they wanted. Now, over 40% of homes on the market have cut prices, and according to Altos Research, this number will continue to move higher.

Adding it up, there’s clearly a slowdown in housing activity underway. And I suspect that activity is going to grind to a halt as the gap between buyer and seller price expectations is too wide and needs time to adjust to today’s reality.

How Far Will Home Prices Fall?

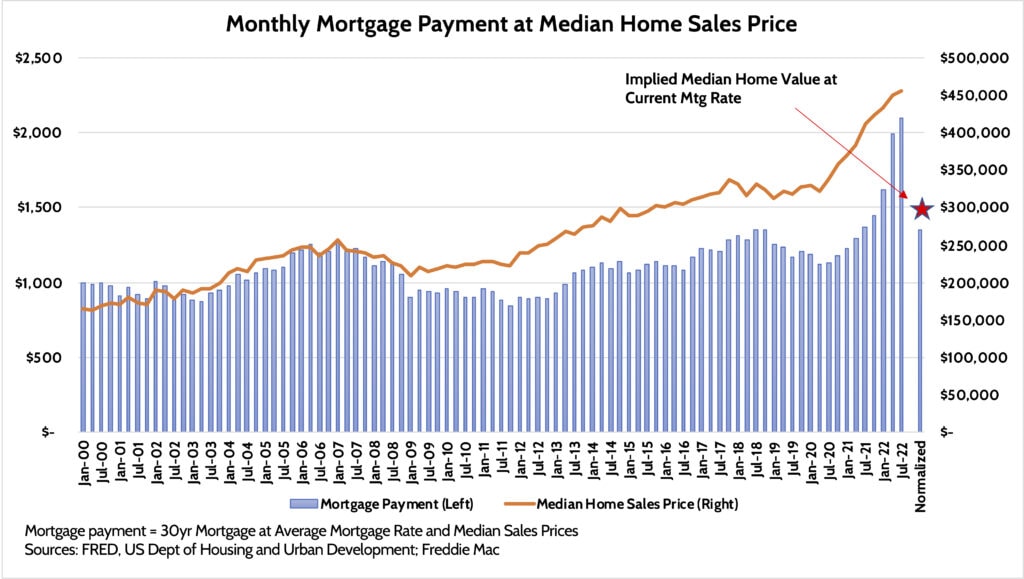

What causes home prices to change? There are a lot of factors, but the #1 factor is mortgage rates. At the end of the day, owning a home with a mortgage is a function of affordability. Meaning, if the cost of carrying a mortgage is too high, you will not be able to buy a home. I’ll describe two methods I use to figure out how far home price might have to fall.

The first way is to focus on mortgage affordability. I first wrote about this dynamic in late 2020 when home prices surged on the back of collapsing mortgage rates. Your monthly mortgage payment is a function of how much you’re borrowing, and at what interest rate you’re borrowing at. Banks will then look at how much that payment “eats up” your monthly income. If the percentage is too high, they won’t give you a loan.

For 20 years up to the pandemic, the average mortgage payment for consumers was around $1,200/month. Home prices rose and fall during that time, but so did mortgage rates, and when taking those two together the calculated payment was remarkably stable.

Over the last several months, the combination of surging home prices and surging mortgage rates has pushed that average mortgage payment for new homeowners to over $2,000/month. That’s unsustainable, as incomes have clearly not increased by 75% during that time!

If we assume mortgage rates stay where they are today (a fair long-term assumption) and assume that the “normal” monthly mortgage payment is $1,300/month, then home prices need to correct by -35%. Is that reasonable?

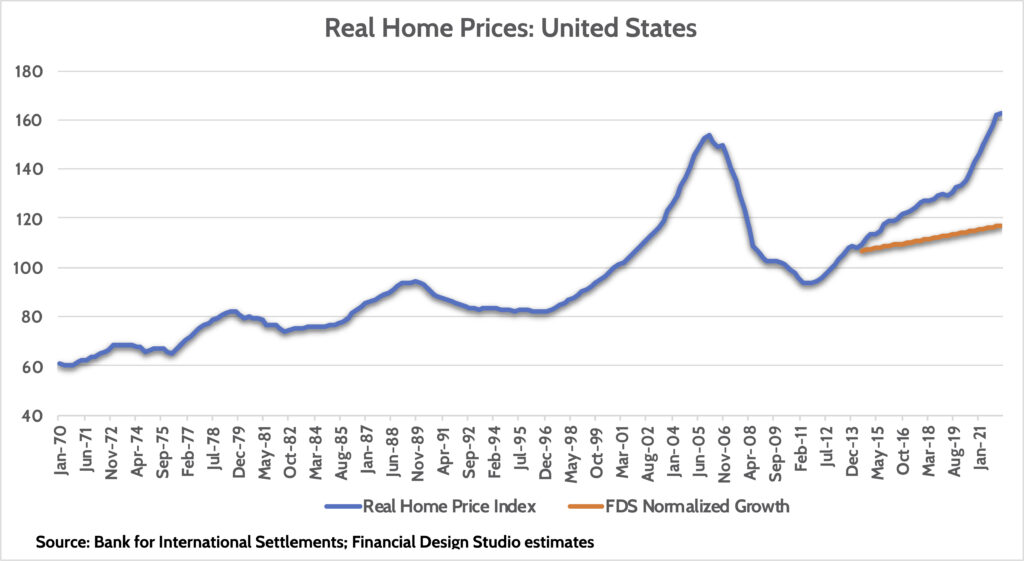

Another way to determine how much home prices might need to fall is to look at real home prices. “Real” home prices track historical home price trends, adjusted for inflation. Going back to 1970, real home price growth has been around +1.5% per year. Meaning, the value of home has increased by Inflation + 1.5%.

We can see in the chart below that after rising steadily from 1970 to 2000, real home prices took off, peaking in 2006. This was the housing bubble. After the bubble burst, real home prices collapsed back to trend, before taking off again the last few years.

As mentioned earlier, mortgage rates significantly influence home prices. After the housing bubble, mortgage rates continued to trend lower before falling to under 3% during the pandemic. Lower rates pushed real home prices up.

If we assume that real home prices returned to “normal” in 2013 and apply a normal real home price growth rate to that level, we can see where real home prices “should be” today (orange line, above). Put another way, real home prices likely need to fall -28% to return to normal levels.

Taking the two measures together our view is that home prices will have to come down roughly 30% on a real basis. This won’t happen overnight. It took five full years for prices to correct after the housing bubble. It will probably take that much time for home prices to adjust to the new, higher mortgage rate environment we’re going to experience in the future. And no, I don’t expect we’ll ever see mortgage rates under 3% or even 4% in our lifetimes.

Falling Home Prices Does NOT Mean a Housing Crisis

Predicting a 30% fall in home prices would seem to qualify as a “housing crash” under most definitions. But there’s an important distinction between this housing cycle and the one we saw in the mid-2000’s.

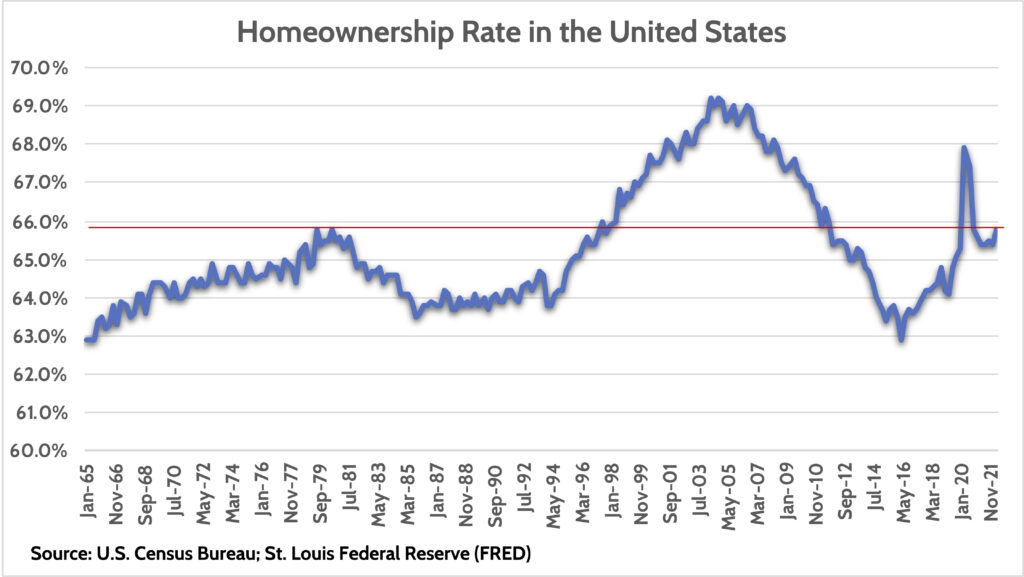

First, homeownership rates in the United States are in line with historical trends. For whatever reason, in our society about 65% of people can sustain homeownership while the other 35% are renters. Efforts to expand the “American Dream” in the mid-2000s through looser credit lending standards pushed the homeownership rate to 69%. This proved to be too high, and when housing collapsed the homeownership rate returned to historical levels.

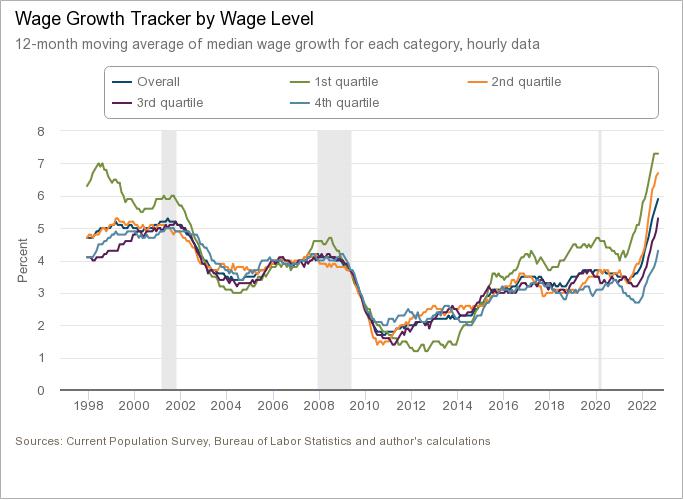

Another reason this cycle is different is unemployment. When you boil it down, housing only “crashes” when unemployment jumps and people can’t make their mortgage payment. The unemployment rate jumped to over 10% in the 2007-2009 housing crisis. I don’t see that happening this time around, even as I expect a recession next year.

Why? Labor markets are much tighter now than they were 15 years ago. This is particularly the case for lower-income workers. This “tightness” is clear in wages for lower-income workers (1st Quartile, green line, below),who’ve enjoyed surging wage growth since 2016.

Yes, home prices are going to come down. And yes, unemployment is likely to rise next year from historically low levels. But we are not in the camp that the housing market is going to crash.

What Does the Changing Housing Market Mean for Buyers and Sellers?

How should buyers and sellers navigate an environment where the housing market is slow for an extended period? Remember, while the market might not “crash,” it’s likely to remain sluggish for the next several years.

For home buyers, the name of the game is being patient. Even though home prices are rolling over, they remain unreasonably high given current mortgage rates. When markets shift as quickly as they have, it can take a lot of time for people’s mentality to change!

Often, home buying is less a desire and more a necessity, usually with growing families. We always tell clients that for a home purchase, your personal situation should be the #1 factor to consider. Paying up a bit for a new home in a better school district and bigger yard will probably be an investment worth paying.

Adjustable-rate mortgages (“ARMs”) might be a good option if you HAVE to buy a home right now. Rates for ARMs are around 1.00-2.00% lower than a conventional 30-year fixed-rate mortgage.

The risk with ARMs, of course, is the future interest rates may be higher than what they are today. You always want to be careful with ARMs because of that feature. But as we’ve canvassed rates, we’re seeing rates under 6.0% for up to 7-year ARMs. If we’re right in forecasting a recession next year, then interest rates (and mortgage rates) may come down a bit, allowing you to refinance and “lock in” a lower rate for 30 years.

For sellers, the changing housing market will prove challenging, but only if you need to move. During 2020 and 2021, most everyone refinanced their mortgage at extremely low interest rates, “locking in” low rates for 30 years. Changing home prices won’t affect you if you don’t need to sell.

Where it will get challenging for home sellers is if you have a life event that compels you to move. A new job in a different location, or desire to upsize/downsize, or to move to a different area. The decision factor you’re going to struggle with is giving up a 3% mortgage on your existing home to buy a new home at a mortgage rate of 6%.

Home Prices and the Rental Market

One final thought on the housing market is regarding rentals. It has become very popular for people to invest in rental properties. I don’t profess to be an expert in the rental market, but here are some things to think about.

Buying a rental unit at a 6% mortgage rate is a much different scenario versus being able to buy one at a 3% rate. Be extremely careful to make sure that your rental isn’t cash-flow negative when you factor in a mortgage, taxes, maintenance, and months where you’re not receiving rental income. If the point of buying a rental is to receive “passive income,” you have to make sure you’re actually going to get a steady income!

Second, I suspect that one of the big attractions of buying rental properties in recent years was driven by surging home prices. Rising home prices likely allowed many rental owners to tolerate little/no cash flow on a property. If we’re facing a sustained period of flat/down home prices, rentals may prove less attractive.

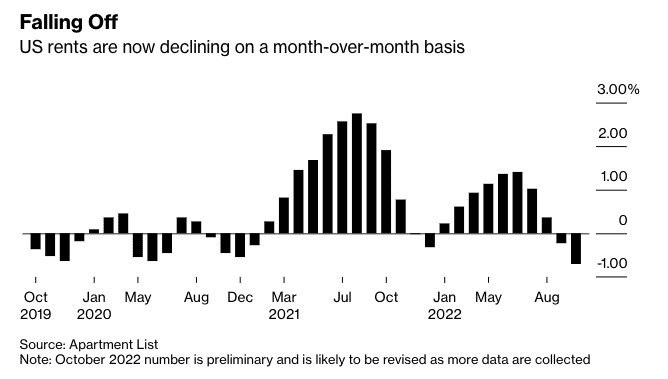

Finally, renters have hit a breaking point on the ever-rising cost of renting. The last two years saw a surge in the rents landlords could charge, but like house prices, that’s changing quickly (above chart). I know many proponents of buying rentals have pointed to the ability to increase rents to drive cash flows higher. But that’s likely going the other way now.

Point is, if you’re in the market for a rental, be careful and make sure the numbers make sense before making the move.

Is the Housing Market Going to Crash?

Based on everything talked about above our answer is, “no.” But we are clearly in for a sustained period of stagnant or falling home prices.

Our conviction on this front is that we’re in a completely new economic world today versus what we’ve grown accustomed to the last 40 years. Inflation is here and is likely to prove sticky. Higher inflation means higher interest rates which mean higher mortgage rates which mean lower home prices.

But don’t let that doom and gloom stop you from doing what you need to do for your family. If it’s going and you need to upsize, then don’t be deterred from making the move.

Next Steps for the Housing Market

Our goal in this post is to give everyone a clear view of how fast the housing market has changed. What you thought you knew about housing six months ago is long gone. It’s a new world now. All that means is that you need to be nimble and do your homework before making a big buying or selling decision.

.png?width=325&height=325&name=Blog%20Contributor%20Headshot%20Style%20(400%20%C3%97%20400%20px).png)

About the Author

Robert Stoll has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm which was eventually merged into FDS.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Rob's Find an Advisor Profile.

Share this

- Good Financial Reads (924)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

7 Smart Strategies to Deal With Inflation

Recapping 2020 Investment Returns and Looking Forward to 2021