These Related Stories

How Do Stock Options Work? Everything You Need To Know!

Share this

.png?width=554&name=BLOG%20IMAGES%20TEMPLATE%20(27).png)

14.0 MIN READ

What are stock options?

Stock options represent the right to:

- buy company stock at a fixed price (“exercise price”)

- during a fixed time period (usually 10 years).

Stock options are a form of compensation. You don’t have to exercise your stock options if you don’t want to. But since stock prices tend to go up over time, you usually end up with the option to buy your company’s stock at a lower price. It’s what I call “instant profit.”

How do stock options work?

If your company is giving you stock options, they will give you a written grant letter explaining the terms. You will need to sign this agreement to accept the grant. The stock options grant letter will state:

- Type of Options Award: This can either be an incentive stock option (ISO) or a non-qualified stock option (NSO).

- Date of Grant: The date when your stock options grant will be made effective. This is important when computing taxes for incentive stock options.

- Option Price per Share: This is the price that you can buy the company stock for at a future date, should you decide to exercise this option.

- Total Number of Shares Under Option: This is the total number of company shares that you will have the option to purchase.

- Vesting Schedule: The series of dates when your stock option vests and become exercisable, along with the number of shares that vests on each date. Stock options usually vest over three, four or five years.

- Expiration Date: Stock option grants usually expire after 10 years.

Below is an example of a stock options grant. Let’s say you just got offered a General Manager position at The Cheesecake Factory (CAKE), and they gave you the following stock options grant.

- Type of Options Award: Incentive Stock Option

- Date of Grant: January 1, 2022

- Option Price per Share: $40

- Total Number of Shares Under Option: 1,000

- Vesting Schedule:

| Date | # of Shares Vested |

|---|---|

| January 1, 2023 |

250 |

| January 1, 2024 |

250 |

| January 1, 2025 |

250 |

| January 1, 2026 |

250 |

- Expiration Date: January 1, 2031

According to this vesting schedule, starting January 1, 2023, you have the option to buy up to 250 shares of The Cheesecake Factory at $40 per share. You’ll need $10,000 in cash if you decide to buy 250 shares. If the stock price of The Cheesecake Factory is $50 per share during that time, then your shares could be worth $12,500. Your “instant profit” would be $2,500.

What are the two types of stock options?

The two types of stock options are non-qualified stock options (NSOs) and incentive stock options (ISOs). ISOs have better tax benefits than NSOs, but have more restrictions attached to it.

What are non-qualified stock options (NSOs)?

Non-qualified stock options (NSOs) are stock options that do not qualify for special tax treatment. You will have to pay ordinary income taxes once you exercise the stock option.

In the example above, if you exercise your NSO on January 1, 2023 and buy The Cheesecake Factory stock at the exercise price ($40) and the stock price then is $50 (fair market value), then you have to pay ordinary income tax on the spread: the difference between the fair market value and the exercise price. In this case, the spread is $10 per share, and if you buy 250 shares, you have to pay ordinary income taxes on $2,500.

What are incentive stock options (ISOs)?

Incentive stock options (ISOs) are stock options that qualify for special tax treatment. You don’t have to pay ordinary income taxes once you exercise the stock option. If you hold the stock for at least a year after purchase before selling, then you only have to pay long-term capital gains tax, which is lower than ordinary income taxes.

Long-term capital gains tax rates for most middle/upper middle class Americans is 15%, and ordinary income tax rates for most middle/upper middle class Americans is 24% or 32%.

In the example above, if you exercise your ISO on January 1, 2023 and buy The Cheesecake Factory stock at the exercise price ($40) and the stock price then is $50 (fair market value), no taxes are due.

If you decide to sell the stock on February 1, 2024 (you’ve held it for more than a year), and the stock price then is $55, you have to pay capital gains tax on your stock price gains, which is $15 per share ($55 less your $40 exercise price).

| Incentive Stock Options (ISOs) | Non-Qualified Stock Options (NSOs) | |

|---|---|---|

| Eligible Recipients | Only W2 employees |

W2 employees and independent contractors |

| Tax at Grant | No taxes due (if exercise price is at least equal to fair market value (FMV) as of grant date) |

No taxes due (if exercise price is at least FMV as of grant date) |

| Tax at Vesting | No taxes due (if exercise price is at least FMV as of grant date) |

No taxes due (if exercise price is at least FMV as of grant date) |

| Tax at Exercise | No taxes due (but spread is taxable for AMT purposes (alternative minimum tax) |

Ordinary income taxes are due on spread (difference between FMV and exercise price) |

| Tax at Sale | Long-term capital gains tax rate is due on sale price less exercise price (if stock is held for at least a year after purchase; otherwise taxed as NSO) | Capital gains tax rate are due on sale price less FMV |

| Limit on Post-Employment Exercise | Yes, ISOs must be exercised within 3 months of employment termination | No limit, as long as it’s before option expiration date |

| Granting Entity Deduction | No deduction | Spread on the exercise is deductible by the company as compensation expense |

| Annual Limit | A maximum of $100,000 is exercisable in any calendar year | No limit |

| Maximum Option Term | 10 years from grant date (5 years for ISOs granted to greater-than 10% shareholders) | No limit, but commonly 10 years from grant date |

Why do companies give stock options?

Companies give stock options to incentivize their employees to stay longer. It costs money for a company to hire and train new staff, so they don’t want you to leave. Stock options vest over several years, and they tend to increase in value over time since stock prices generally rise over long periods. Because of this, the employee has an incentive to stay and wait to exercise those stock options to get additional money.

Stock Options Lifecycle

Stock options go through the following six lifecycle stages, regardless of whether they’re ISOs or NSOs.

- Grant: You are awarded an option grant through an options agreement. It will contain your exercise price, total number of shares you can buy, and the vesting schedule.

- Plan: Stock prices will swing wildly, so it’s best to have a plan in advance. In what circumstance will you exercise your option? When will you sell the stock? What will you do with the proceeds?

- Vest: Stock options can vest every year for over 4-5 years. A common vesting schedule is 25% after one year, and then monthly or quarterly thereafter.

- Exercise: Once it vests, you now have the right (not a requirement) to purchase company stock at the exercise price. If the current stock price is higher than your exercise price, then it’s usually profitable to exercise your stock option. It’s like buying stock at a discount.

- Sell: At some point, you may decide to sell the stock according to your initial plan. You can sell it immediately, wait for a year, or hold it for a long period. You may owe capital gains taxes upon sale.

- Use Proceeds: Will you use your proceeds for an upcoming vacation? For a vacation home? Or will you invest the proceeds in a diversified portfolio?

Exercising Stock Options

How do I know when to exercise stock options?

You may want to exercise your options if:

- Your options have value. Check the current company stock market price at Yahoo Finance. Check the exercise price in your options grant letter. This is the price you can buy the stock for. If the current stock price is greater than the exercise price, then you will be able to buy the stock at a discount. That’s instant profit for you.

- You have extra cash. If your option allows you to buy 1,000 shares of stock at $40 per share, you have to cough up $40,000 to complete the purchase. Do you have that cash? You don’t want to drain your bank account just to exercise your stock option. (Some companies allow a cashless exercise.)

- You understand the tax implications. If you exercise an NSO, you have to pay federal and possibly state/local taxes on the spread (difference between the current stock price and exercise price). If you’re in the 32% tax bracket, then be prepared to give about a third of your profit to Uncle Sam! If you’re exercising an ISO, no taxes are due at exercise but the spread is taxable for AMT purposes.

- You have a plan in place. What are you going to do after you’ve exercised your options? Will you hold or sell? It’s tempting to hold your company stock if you’ve seen the price continuously rise over the past years. But is that the best option? If you sell, what will you do with the proceeds? Is it time to buy that vacation cabin you’ve been dreaming about, or invest in a rental property or the stock market?

- Your stock options are about to expire. Elon Musk was awarded Tesla stock options in 2012 as part of a compensation plan. The 2012 award was for 22.8 million shares at an exercise price of $6.24 per share. Tesla shares closed at $1,089.01 on November 17, 2021, meaning his gain on the shares totals just under $25 billion. Musk’s options expire in August of 2022, so he will have to exercise his options before then to get all that money.

How to exercise your stock options

Step 1: Log into your equity website

The first step is to log in to see how many stock options are vested and non-vested. Vested stock options are exercisable and non-vested stock options are not exercisable. You may have multiple options that are exercisable if you are a longtime employee.

Step 2: Select how you will pay

- Pay in cash (exercise and hold): If the company is still private then this is your only selection. You use your own money to purchase the shares and you keep all of them. The payment will be wired from your bank account. This is the riskiest method.

- Cashless exercise (exercise and sell): If the company is public then this option may be available to you. You don’t have to have any cash to exercise the option or pay withholding tax. You purchase the shares and then sell them in one transaction. Companies such as Schwab, E*Trade and Shareworks use some of the sale proceeds to cover the exercise cost and tax withholding.

- Cashless sell to cover (exercise and sell to cover): If the company is public, then this option may be available to you. You will exercise your option and sell only enough to cover the price, commissions, fees, and taxes. You then keep the rest in the form of company stock.

| Method | Cash paid to exercise |

Cash received at exercise |

Shares used to exercise |

Shares received at exercise |

|---|---|---|---|---|

| Pay in cash | Yes | No | No | Yes |

| Cashless exercise | No | Yes | Yes | No |

| Cashless sell-to-cover exercise | No | No | Yes | Yes |

Step 3: Pay tax withholding

Your company must withhold income taxes and payroll taxes if you exercise NSOs. It is best to consult with a tax professional as the amount withheld may not meet your total tax obligation.

Step 4: Exercise your stock options

Exercise your options through your equity website.

Step 5: Ensure correct tax forms are completed

If you exercised ISOs, then the company will file Form 3291 with the IRS and give you a copy. This form doesn’t need to be attached to your tax return. If you exercise ISOs and then hold the resulting stock through the calendar year of exercise then you will need to do an AMT calculation on Form 6251. Once again, it’s best to consult with a tax professional to determine your tax obligations.

Selling Stock Options

When should I sell my stock options?

If you exercise your stock options, you have three possible choices on when to sell:

- Sell it immediately to lock in your profit and to avoid the risk of holding an individual stock;

- Hold it for at least a year before selling, to get favorable tax treatment (long-term capital gains tax); or

- Hold it for more than a year, if you think the price of the stock will continue to rise. Be aware of the risk of holding an individual stock.

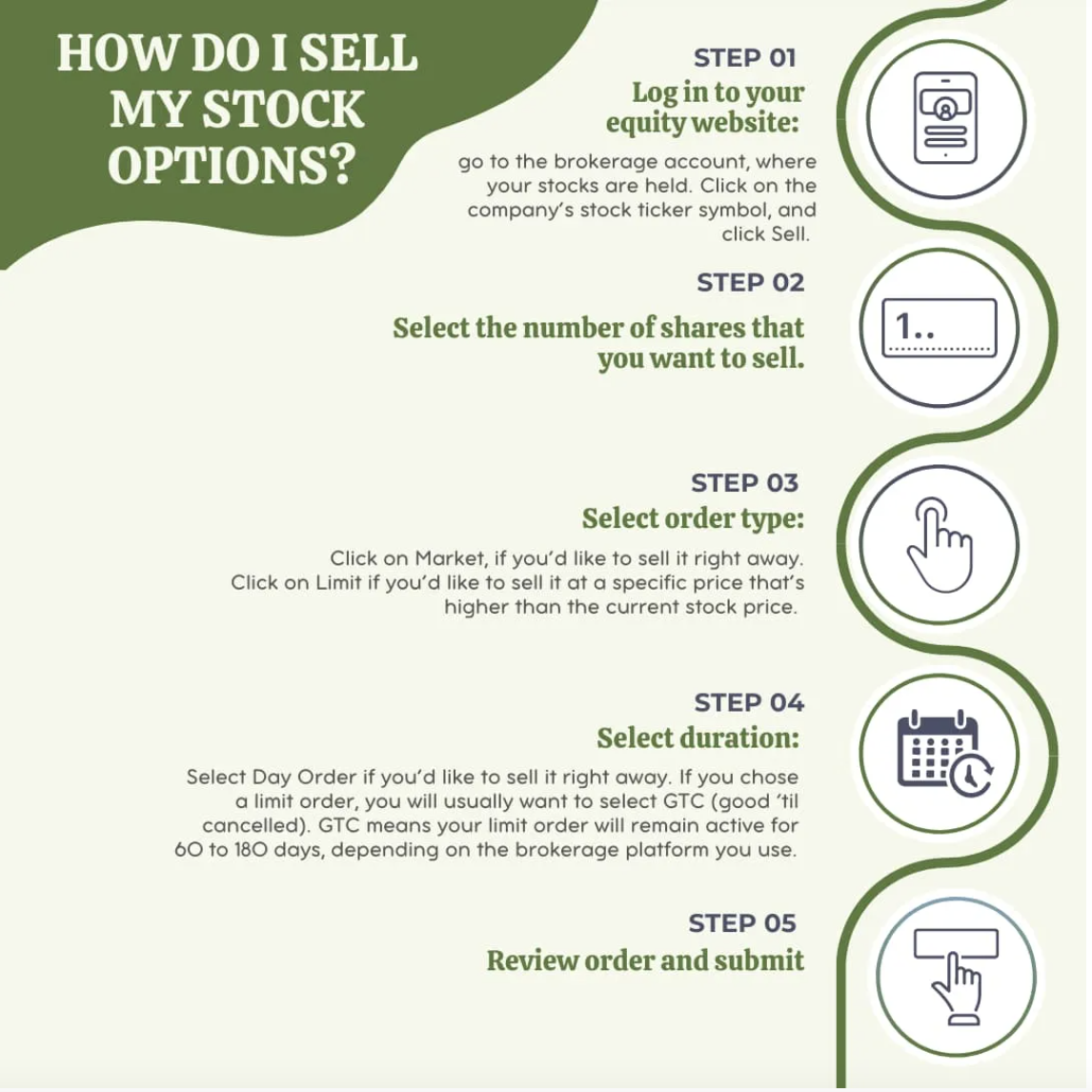

How to sell stock options

Once you exercise your stock options, you now own the company stock shares. You will see this in your brokerage account. Selling the shares is just like selling any other stock.

Step 1: Log in to your equity website

Go to the brokerage account, where your stocks are held. Click on the company’s stock ticker symbol, and click Sell. If you see a drop down button across the company’s stock name, click on that and click on Trade.

Step 2: Select number of shares

Enter the number of shares you would like to sell. Some platforms have a “Sell All” option.

Step 3: Select order type

Click on Market, if you’d like to sell it right away.

Click on Limit if you’d like to sell it at a specific price that’s higher than the current stock price. You’ll need to specify at what price you’d like your stock to be held. Note that there’s no guarantee that the stock will ever reach that price. If it doesn’t, your stock may never get sold.

Step 4: Select duration

Select Day Order if you’d like to sell it right away. If you chose a limit order, you will usually want to select GTC (good ‘til canceled). GTC means your limit order will remain active for 60 to 180 days, depending on the brokerage platform you use.

Step 5: Review order

Select Preview Order, then review the accuracy of your order. If you’re satisfied, click on Submit.

Taxes for Stock Options

How are stock options taxed?

Incentive stock options (ISOs) are taxed differently from non-qualified stock options (NSOs).

For ISOs, no taxes are due when the options are granted and when they vest. No taxes are due when they are exercised, but the spread (fair market value less exercise price) is taxable for AMT purposes. If you hold the stock for at least a year after purchase, you pay long-term capital gains taxes on the sale price less the exercise price.

For NSOs, no taxes are also due when the options are granted and when they vest. When you exercise the NSO, you pay ordinary income taxes on the difference between the fair market value and the exercise price. You pay capital gains tax on the sale price less the fair market value.

Taxation of non-qualified stock options

When you exercise non-qualified stock options, you have to pay federal, state, and local taxes on the difference between the fair market value and the exercise price. Fair market value is the price of the stock when you exercise your option. When you decide to sell the stock, you have to pay capital gains taxes on the sale price less the fair market value.

Taxation of incentive stock options

When you exercise your incentive stock option, you don’t pay any taxes. However, the spread (fair market value less exercise price) is taxable for AMT purposes. If you hold the stock for at least a year after purchase, you pay long-term capital gains taxes on the sale price less the exercise price. Otherwise, it is taxed like non-qualified stock options.

How can I reduce my stock options taxes?

To reduce your stock options taxes, exercise your options during the year when your household income and tax bracket is lower (for example, your spouse was in between jobs). Holding the stock for at least a year after purchase before selling will also reduce your taxes.

Are option losses tax deductible?

Yes, option losses are tax-deductible. It’s just like any other stock. If you sold your options at a loss, then it will result in either a short or long-term capital gains loss, which will reduce your taxable income.

Some other questions you may have about stock options

How to calculate what your stock options might be worth

Look up your company’s stock price in Yahoo Finance. Let’s say it’s $50/share. Open your options grant letter and look up your stock options exercise price. Let’s say it’s $30/share. To calculate what your stock options might be worth, subtract your exercise price from the current stock price. In this case, the stock option is worth $20/share ($50 – $30).

What does it mean to exercise an option?

To exercise an option means you’re exercising your right to buy a stock at a predetermined price (exercise price). You usually will want to exercise your stock option if the stock is currently trading at a price higher than your exercise price. If you do so you can generate an instant profit.

When are stock options exercised?

Once your employee stock options vest, you can exercise the stock option. You may want to exercise your stock option if: 1) your options have value (trading price is higher than exercise price); 2) you have the cash to exercise the option (=buy the stock); 3) you understand the tax implications, 4) you have a plan in place on what to do after you exercise your stock options; and/or 5) your stock options that have value are about to expire.

What is stock options trading?

Stock options trading is the buying and selling of open market stock options. You can buy or sell either call or put options. Buying a call option at a specified strike price will enable you to buy that stock at that specific price. An options trader will buy a call option if s/he thinks that the stock price will increase in the next few days or weeks.

Buying a put option at a specified strike price will enable you to sell that stock at that specific price. An options trader will buy a put option if s/he thinks that the stock price will decline in the next few days or weeks.

You can also sell a call or put option. If you do so, you get a little bit of income. But if the buyer of that option exercises it, you will be forced to buy or sell the stock at a great loss.

The gains and losses in stock options trading are magnified.

Are stock options risky?

Trading open market stock options is extremely risky. You can win a ton of money, but you can also lose a lot of money. It’s like gambling.

If you buy a call option, and the stock price increases by 2.5%, the value of your call option might increase by 25%. Huge gains! But if the stock price declines by 9%, your call option might plummet by 90%… ouch! You can see the same wild swings with buying put options.

If you sell a call or a put option, you can get a little bit of income. Usually you’re selling options way out of the money, meaning there’s a low likelihood that the other party will be able to exercise it. But if that 5% or 10% chance happens, you’re toast.

Selling options for income is like picking up free quarters on the road, while a steamroller is right behind you.

Are options better than stocks?

It’s tempting to trade options rather than stocks to make quick money. While I’m writing this, Nordstrom stock is up by more than 6%, trading at around $35/share. If you own Nordstrom stock, you just made a +6% return. But if you owned a Nordstrom stock call option with a strike price of $31, your option is up by +67%! If you owned the $35 strike price, you’re up by 170%!

Be very careful, because you can experience the exact opposite. While I’m writing this, Warby Parker’s stock is down by -9.7%, trading at $53.70. If you’re a stock owner, you’re down by that much. If you owned a Warby Parker call option with a strike price of $55, you just lost 85% of your money.

Options trading is like playing roulette. So no, options are not better than stocks.

About the Author

About the Author

Alvin Carlos, CFP®, CFA is an investment advisor and fee-only financial planner, in Washington, D.C that works with clients across the country. He has a Master’s degree in International Relations from SAIS-Johns Hopkins. Alvin is a partner of District Capital, a financial planning firm designed to help professionals in their 30s and 40s achieve their financial goals through smart investing, reducing taxes, retirement planning, and maximizing their money.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Alvin's Find an Advisor profile.

Share this

- Good Financial Reads (924)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

Good Financial Reads: Your Employee Stock Options, Part Two

Good Financial Reads: How To Use Equity Compensation, Pre-IPO and Acquisitions