These Related Stories

Good Financial Reads: Advice For Grads

Share this

Following along with the blogs of financial advisors is a great way to access

valuable, educational information about finance — and it doesn’t cost you a thing! Our financial planners love to share their knowledge and help everyone regardless of age or assets.

Catch up on the latest posts with this week's roundup:

How To Take Control of Your Finances After Graduation

by Bill Nelson, Pacesetter Planning

Congratulations to everyone in Class of 2017! If you are finishing your undergraduate career this month, welcome to the working world! If you are finishing a masters or professional degree program, congratulations on finally (probably?) being doing with school! And if you didn’t graduate this year, stick around anyway- I have some information here for you, too.

As the excitement of your graduation weekend ends and you begin to take the next steps on your journey, whatever they may be, I recommend that you take a step back and take an assessment of your current financial landscape. Your life is changing (for the better!), and as such, you should take some time to reflect and take action to set yourself up for financial success in your new endeavors.

3 Money Tips for a New Graduate

by Anna Sergunina, MainStreet Financial Planning

Spring is my favorite time of the year. We become more active with outside activities, start to travel and of course, our expenditures increase. The month of May also means graduations and new beginnings for many young adults. I want to share with you the financial advice I wish I had received when I was in my 20s, but I didn’t. I had to learn the hard way! I became a certified financial planner. You don’t have to!

Just Graduated College, What Now?

by Andrew Damcevski, TruWealth Planning

So you’ve graduated college… Congrats! Now what? All of the jokes about the real world and having more responsibilities are starting to become more true and less funny. Relax, the real world doesn’t have to be so scary. Here are a few things that will help lower the stress, and increase the joy of being an adult.

Top 9 Mistakes Young Professionals Make With Their Money

by Devon Klumb, TruWealth Planning

To all the young professionals out there reading this, we want you to know that we get it. The struggle is real when it comes to managing your finances and balancing the rest of life’s curveballs successfully. We tend to see a lot of our clients making some simple mistakes that can be easily prevented with a little intentional planning.

Here are 9 of the most common mistakes we see young professionals make with their money.

Conversations about College

by Tyler Reeves, Plimsoll FInancial Planning

Graduation season is coming. It's an exciting time if you’re a high school student. Maybe not so much if you’re the parent of a high school student.

Planning for college is hard.

Tuition rates have outpaced general inflation and wage growth for years. And that’s doesn't seem to be slowing down anytime soon.

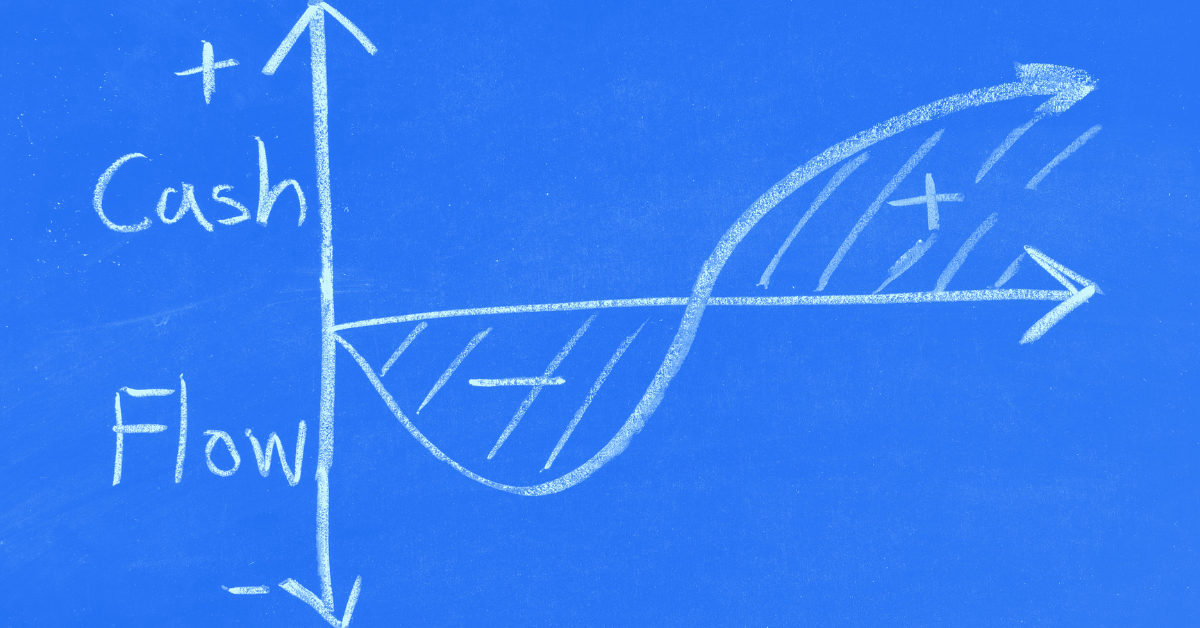

Add that to the fact that these college planning years coincide directly with valuable retirement savings years, and you can quickly find yourself cash flow poor. Not to mention, kids are expensive before you even consider college tuition.

Share this

- Good Financial Reads (925)

- Financial Education & Resources (892)

- Lifestyle, Family, & Personal Finance (865)

- Market Trends (114)

- Investment Management (109)

- Bookkeeping (55)

- Employee Engagement (32)

- Business Development (31)

- Entrepreneurship (29)

- Financial Advisors (29)

- Client Services (17)

- Journey Makers (17)

- Fee-only advisor (12)

- Technology (8)

Subscribe by email

You May Also Like

Good Financial Reads: Money Books for New Grads, What to Consider Before Accepting a Job Offer, and More

Good Financial Reads: Do You Really Need to Make Money, Using Financial Failures to Move Forward, and More